UX Research Best Practices for Online Gambling

The gambling and betting industry is highly competitive, with companies striving to provide engaging entertainment while working closely with authorities to prevent addiction and money laundering. Despite the popularity of using nicknames and usernames on these platforms and social media, users refuse to reveal their true identities. They are generally hesitant to meet in person due to social stigma and other concerns. Addiction remains a taboo topic and is not commonly discussed. Thankfully, we live in times of remote meetings, which make research much more accessible.

💡 For instance, we use our GR8 CRM tools to distribute questionnaires and identify potential participants for conducting interviews.

Many user research methods can be used for different needs, but I will mention the most used in iGaming: in-depth interviews, usability testing, and surveys.

Not all research methods suit iGaming operators since some can be difficult to execute. Some, like A/B testing, are distinct fields.

🎤 In-depth interviews

In-depth interviews are a great way to get to know your users better. If you're starting to do research on your product, interviews are perfect for building a user knowledge base. During these interviews, you can learn a lot of helpful information about how your product is used and even empathize with those who use it.

It's important to have a good understanding of your end-users to develop your product successfully. You can talk to all users at this stage without selecting them by specific characteristics. But when you have more specific topics for the interview, it's best to choose a suitable sample whose experience will help answer your questions. For instance, if you want to learn about first-time users' experience with the product, their learning curve, and the problems they may face, it's best to select newcomers who still have a fresh perspective.

💡 When asking users for feedback, we found that offering them something in return was effective. You can provide free tickets to competitions, bonus cash prizes for the account, or gift certificates. This approach helps testers give more natural and detailed opinions. It's also a way to keep users engaged in the community and encourage them to continue participating in the future. By offering incentives, we ensure users put in their best effort to stand out and access rewards.

🔨 Usability testing

Usability testing is a valuable opportunity to test an idea or an interface solution quickly and affordably. It is only sometimes necessary to conduct many tests to obtain reliable data; just 5-10 tests can cover up to 80% of the potential issues that users may face with a given solution.

There are two ways to conduct tests: moderated and unmoderated. Moderated tests involve meeting or calling the user, showing them a prototype, giving them tasks, and watching them complete them. For unmoderated tests, we use tools such as Lyssna and Maze, which help us scale user insights and develop more data-driven products. Regardless of the format, the main goal of these tests is to ensure that users can efficiently complete tasks without encountering any issues or confusion with the interface.

💬 Surveys

Surveys are a highly effective and convenient method of gathering quantitative data about users. They provide us with valuable insights into the extent of a particular issue or need for distribution, even if we already have some interesting information about our users. To improve the quality of our research, we have integrated tools like Hotjar and Alchemer into our GR8 platform. We use Hotjar to create quick and easy surveys, while Alchemer is better suited for larger and more complex surveys.

Additionally, surveys can be attached to your website, emailed, or delivered through the notification center. By trying out different options, we can determine which communication channel works best and what percentage of users complete the survey.

📌 For example, we can conduct massive surveys on our platform. Users receive a notification and can open the survey form from Alchimer integrated into the product interface. We record the user ID and segment their responses based on different indicators. In the surveys, we also ask an optional question to see if users are willing to participate in qualitative research with additional questions. And then, we recruit these users for in-depth interviews.

Of course, conducting research requires additional costs, such as tool subscription fees and player bonuses for completing interviews. Despite these expenses, the research benefits are worth the investment as it helps us better understand our users and improve their overall experience.

💡 To find the best tool for storing user research data, check out our article on Why Betting Companies Need a UX Research Repository.

📈 The Kano Analysis Model

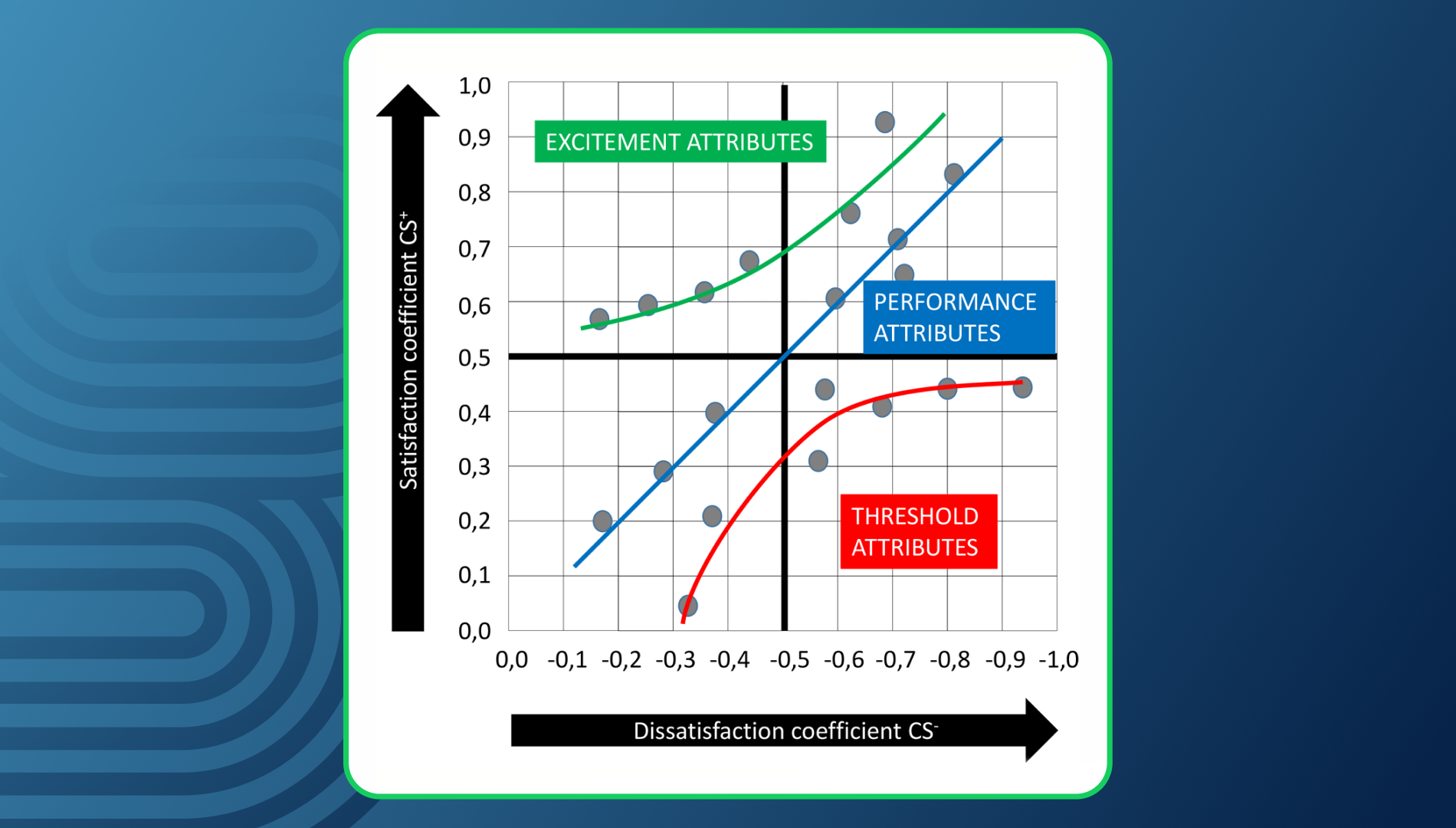

The Kano Analysis model helps businesses prioritize product features based on customer satisfaction and implementation investment. It uses a questionnaire to categorize features on two-axis scales: satisfaction and functionality.

What the Kano model aims to determine:

- How would a person react to the fact that a product has a certain function or some attribute is made well?

- How would a person react to the fact that a product does not have a particular function or that some attribute is poorly made?

Example questions using the Kano model:

How would you feel if the picture quality on your TV was poor? For example, twice as bad.

- I like it

- This is natural (expected)

- I don't feel anything, and I don't care

- I have no choice (I don't like it, but I can live with it)

- I do not like it

- Some Other reply

How would you feel if the picture quality on your TV was poor but not twice as bad?

- I like it

- This is natural (expected)

- I don't feel anything, and I don't care

- I have no choice (I don't like it, but I can live with it)

- I do not like it

- Some Other reply

As a result, you receive a schedule of attribute segmentation:

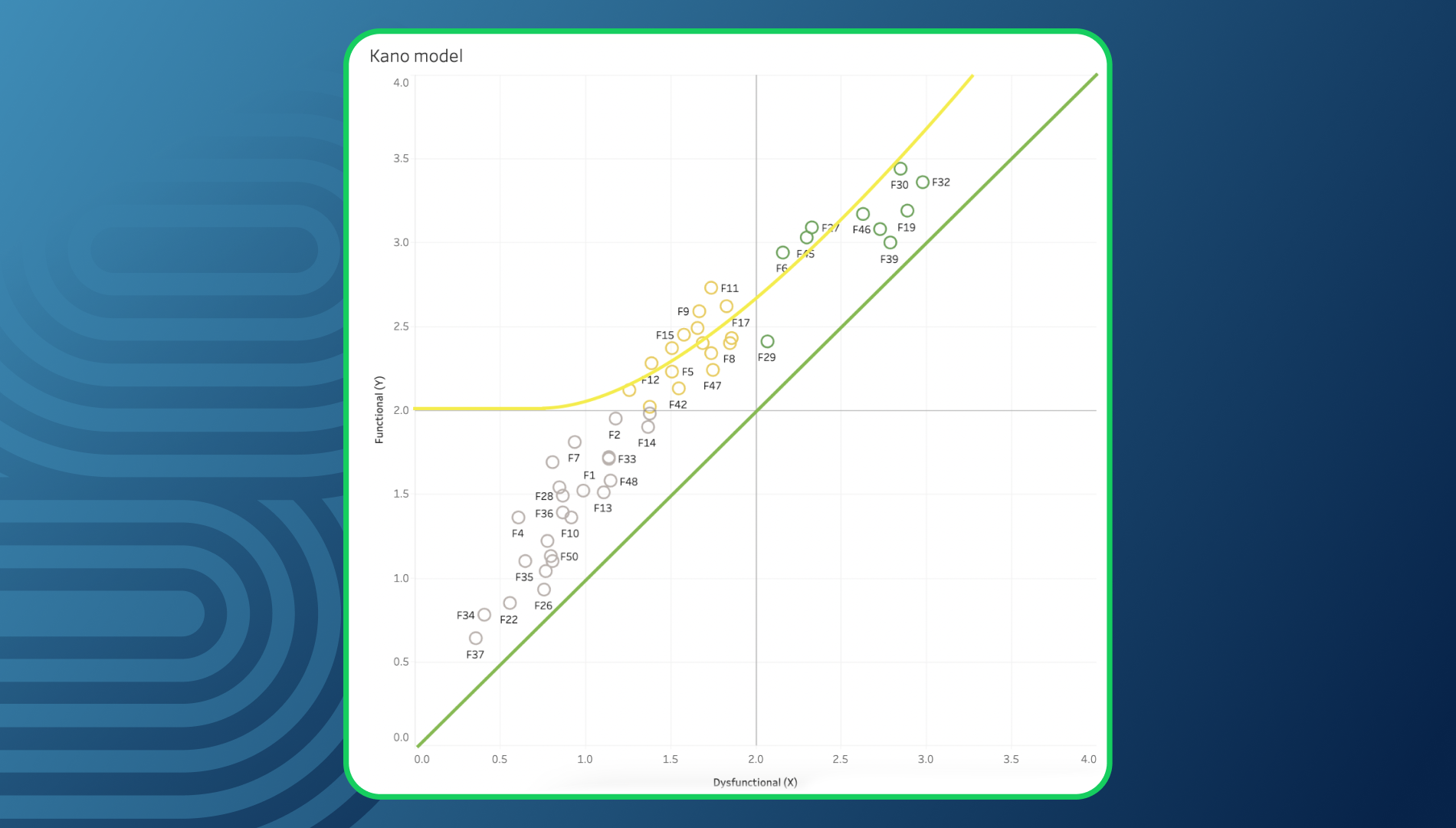

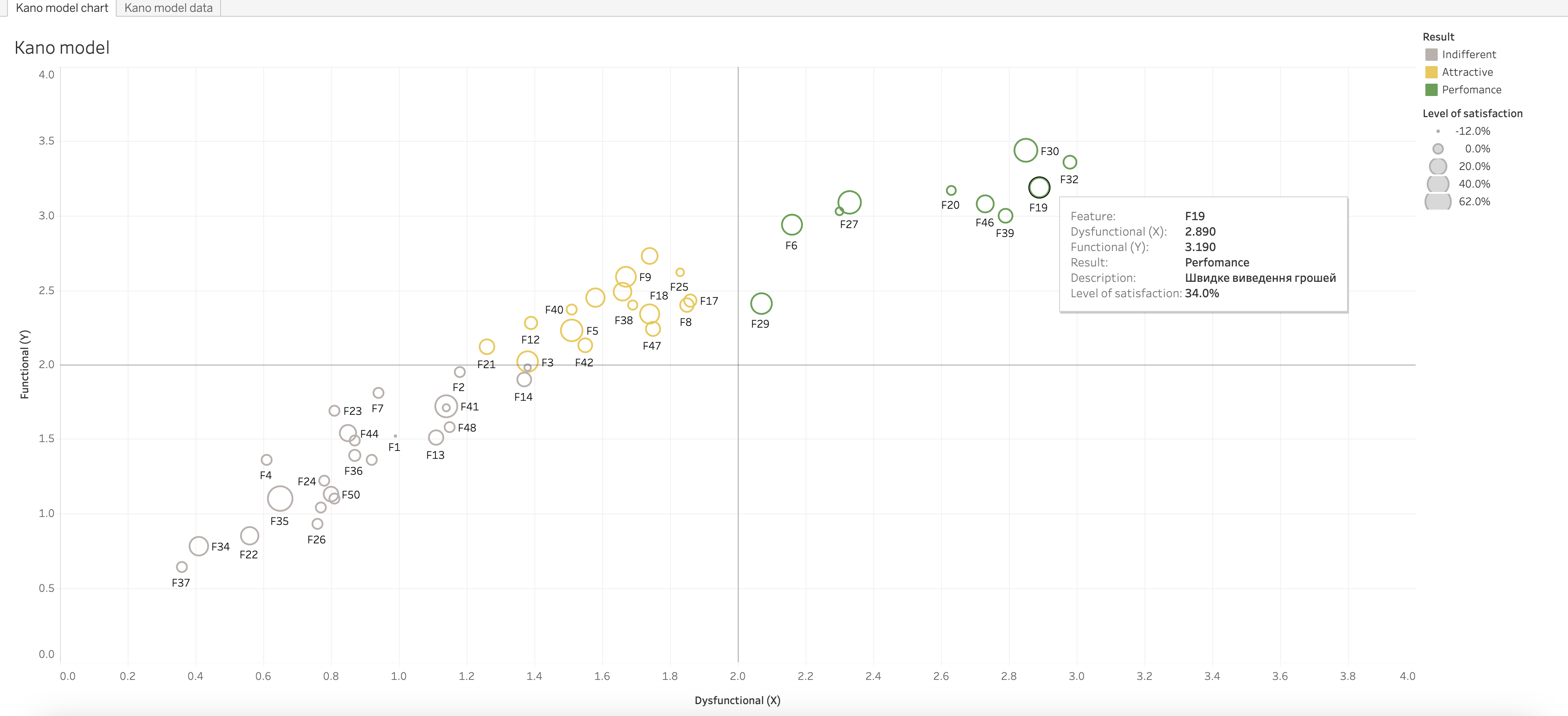

📌 After slight adaptations of the Kano model to our industry, we conducted a survey to determine user satisfaction levels and the potential for further function development.

What we asked users:

- Do you use the “X” function?

- On a scale of 1 to 10, how would you rate the development of the “X” function?

- Please provide your feedback on how we can improve the “X” function.

When plotted on the coordinate axis, the emotional reaction of customers is shown by the placement of the function, while the size of the point indicates the level of satisfaction.

The Kano model-based surveys help us accurately prioritize the client's needs and determine which features are essential and which are less critical. This enables us to efficiently manage the backlog and avoid wasting resources on costly and unnecessary development.

According to the research, our clients' users highly appreciate the availability of fast cash-out options.

Sometimes, operators might want to add features that are optional to their product. In these cases, we use the Kano model to research which functions are important for users and which are not. Research should include all functions, even those that still need to be implemented.

Andrii Demianiv, GR8 Sportsbook Product Manager

Why Gambling Businesses Need User Research

If you have users, your business needs user research. Research is crucial because understanding users' needs and challenges is the key to developing a product that they will want to use more. UX research helps increase user retention, enhance conversion rates and average turnover, identify and solve usability issues, improve customer support, and foster competitive advantage.

UX Research Saves You Money

By testing solutions before moving on to development, operators can avoid spending on features that don't have real value or that users find difficult to use. We can reject or improve an idea with a Figma prototype and 5–10 users before it fails on prod.

We were working with an operator who wanted to add fantasy football to their platform. However, we did some research using the Kano model and found that users didn't really care about this feature when picking a bookmaker. So, we decided to hold off on developing it and focus on other features.

Andrii Demianiv, GR8 Sportsbook Product Manager

UX Research Helps Better Understand Your Audience

As service providers, we commonly have a different perspective than users and use terminology unfamiliar to them when discussing the product. And this is ok. The gap in understanding happens because we may belong to different social groups and have varying experiences that shape our understanding.

However, it is crucial to bridge this gap and create a product that caters to the users' needs, connecting with them and gaining insights into their expectations and preferences. UX Research here serves as a helpful tool to simplify the product design process, particularly in industries with complex jargon and rules, like gambling. By investing in user research, we can ensure that our product is user-friendly and meets the needs of players.

📌Here are some user segments that you can use for research to ensure that the results are relevant to a particular feature:

- By product: casino, sports betting, or casino+sports betting.

- By activity: how often the user bets or plays in the online casino.

- By registration date: whether the user is an experienced or a newcomer.

- By gambling user experience: this depends on the research. For instance, we may segment users based on whether they used the top express functionality or not, those who participated in gamification competitions, and those who ignored this functionality.

3 UX Research Steps for Re-design the Product

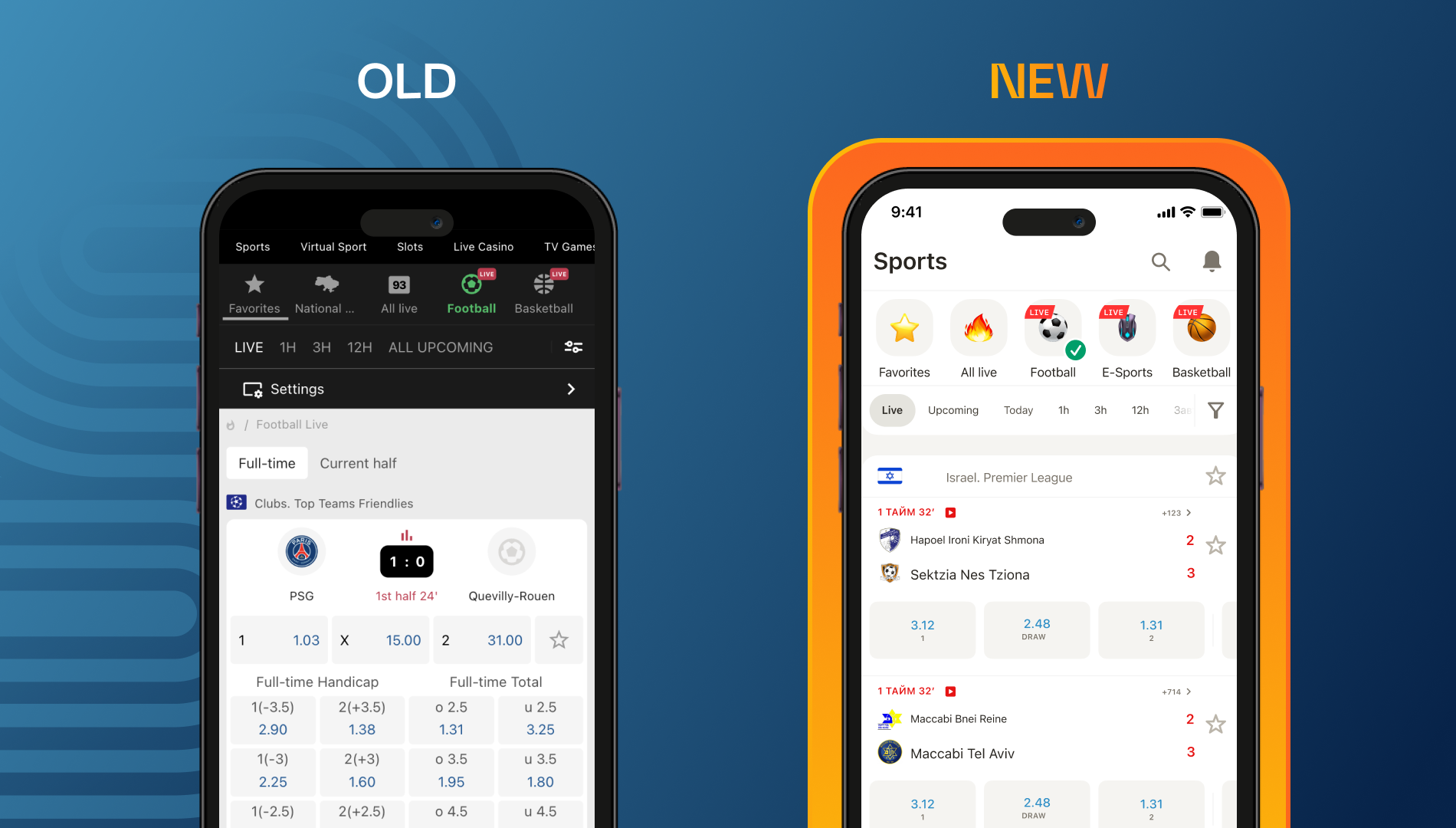

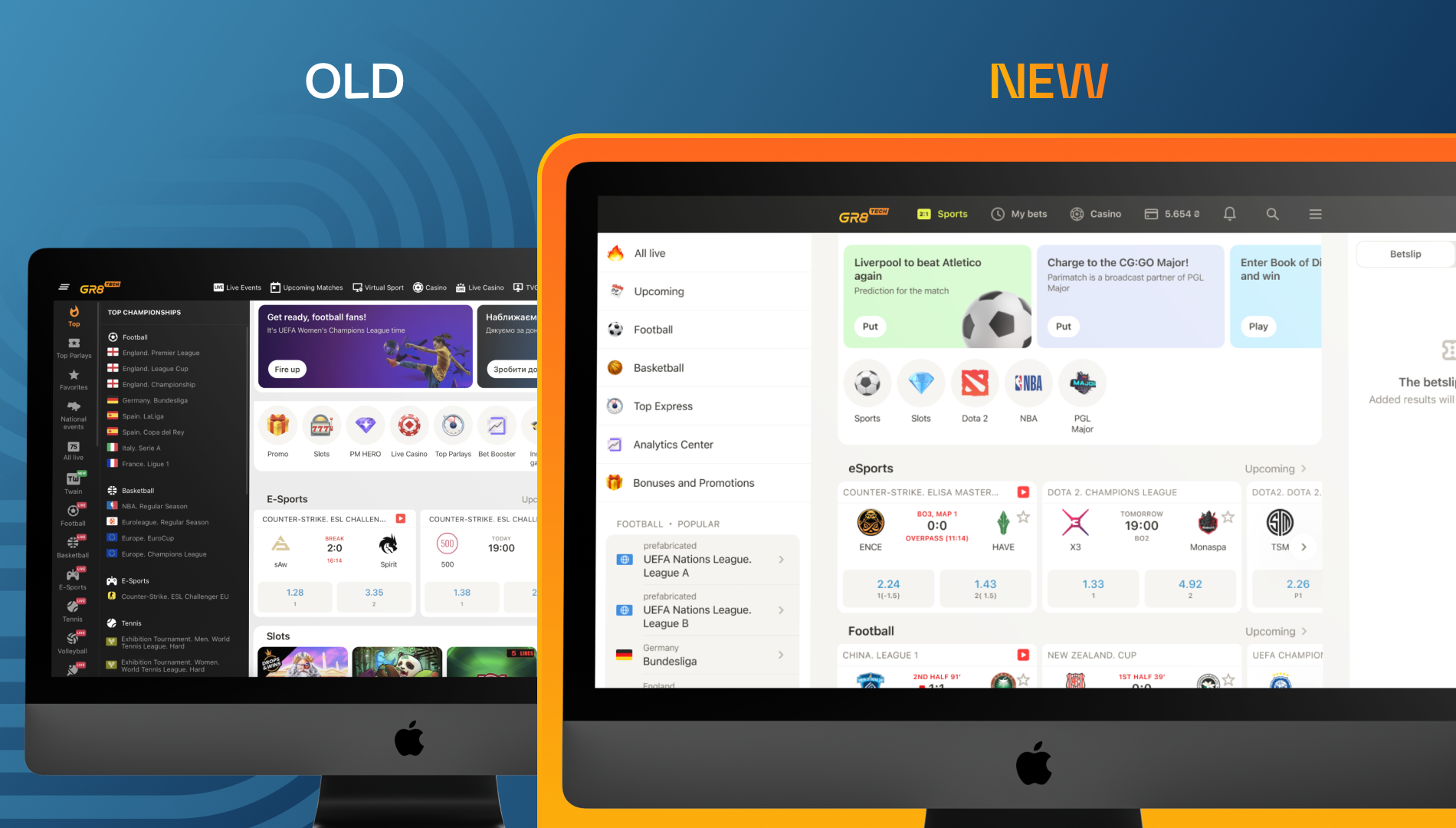

A while back, we undertook a significant project of revamping our client’s website to make it more user-friendly across all devices and mobile applications. I bring up this project as an illustration of how valuable UX research can be in achieving a successful outcome.

All significant shifts, like a redesign, should be approached carefully, as users prefer avoiding changes, and businesses want to avoid revenue losses. Thus, our user research had several stages.

⚠️ Before redesigning our client’s product, we separated it into different components. To conduct research, we chose a group of active users to participate in a focus group. We didn’t need numerous participants at this stage, so 20 people were enough. It’s also important to note that this process stage did not involve a quantitative survey or form part of an A/B test.

Stage 1: Pain points

During the first stage of our design process, we aimed to identify the pain points that users experienced with the old design. To achieve this, we conducted qualitative research in the form of Usability tests. These tests enabled us to formulate hypotheses based on the user feedback we received.

It is important to note that qualitative methods are not suitable for calculating or estimating proportions or prevalence. Therefore, in the next phase, we will conduct surveys to confirm our hypotheses using quantitative methods. These surveys will allow us to gather and analyze statistical numerical data, giving us a more accurate understanding of the casino and betting user experience.

Stage 2: Prototype

During the second stage of our design process, we create a prototype based on the initial design. The prototype is then presented to a focus group for feedback. Depending on the complexity of the design component, the improvement iterations and user surveys can vary from 1 to 2-3 in number. Once the prototype has been refined and receives positive feedback, we move on to the development stage.

Stage 3: A/B Testing

When conducting user research, A/B tests are performed after the development phase on a larger sample of users to ensure that the results are statistically significant. If the A/B tests reveal a successful outcome, then a subset of users from the test group are selected to receive a survey that evaluates the quality of the new design. We invite these individuals to rate the design and provide feedback on their experience.

Making significant product changes without User Research is like tossing a grenade and hoping it doesn't explode.

Andrii Demianiv, GR8 Sportsbook Product Manager

Results Leading to Benefits for the Business

Our clients have seen some significant benefits from doing UX research, especially regarding usability tests. By testing out different changes to the interface and other parts of the product, we've avoided making any major mistakes or causing any big problems. This is especially important because people usually don't like changes, especially if they're already used to a product.

Through speaking with users, we've learned a lot about the issues newcomers face, why some people leave our product, and what players like and don't like about our competitors. We've also heard about users' challenges when they sign up, deposit money, place their first bet, and withdraw funds.

To increase user loyalty, it is critical to store data and actively apply it to improve the product. By doing so, users will spend more time using the product, share their positive experiences with friends, and are less likely to look for competitors' products to replace yours.

🔎 What do you find most interesting about user research in iGaming? Drop a comment below, and we'll make sure to cover the juiciest bits of this topic in our future posts. ⬇️⬇️⬇️