The Brazil sports betting market continues to snowball, generating billions of Brazilian reals in revenue each year. Football and a gambling-friendly mindset contribute to expanding betting in the country and intensifying competition. Each player tries to grab a piece of the pie, but without understanding the market, most are doomed to fail.

Here, we arm you with the reasons behind the Brazilian sports betting boom, including market characteristics, regulations, tech trends, and growth opportunities.

Why Brazil

Because it’s huge! Brazil's population exceeds 200 million, making it the 7th most populous country globally. Around 90% of the population resides in urban areas. By 2024, Brazil's GDP is projected to rank 11th worldwide. Notably, the middle class in Brazil is expanding, comprising 48% of the population, according to IBGE SET. Following an economic downturn in 2015 and 2016, Brazil was on a slow path to recovery, which was further hindered by the pandemic. However, there are optimistic forecasts for growth in the coming year.

In response to a period of price stability and high inflation, Brazil has been reclaiming monetary control by raising interest rates to 13.75%. Post-pandemic, Brazil resumed its economic growth, leading to a successive decrease in the unemployment rate, which now affects 8.9% of the population (9.7 million people).

Despite the increasing number of elderly individuals in Brazil, a significant portion of this demographic remains economically active, with 25% of those over 50 years old participating actively in economic activities, generating more than R$3 trillion.

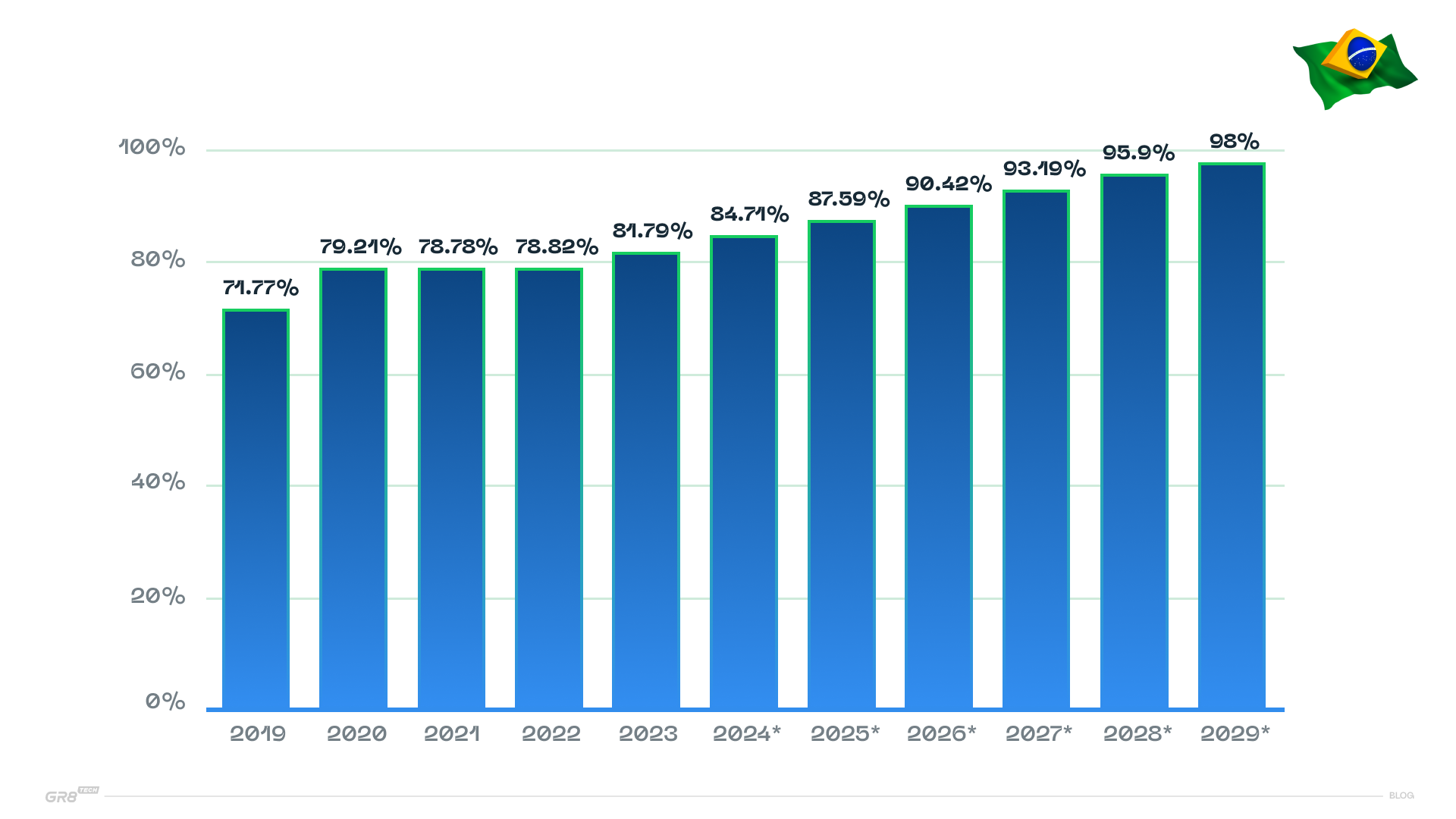

Moreover, Brazil boasts a high level of internet penetration, reaching 84.7% in 2024, with a projected growth rate of 98% by 2029.

Internet Penetration Rate in Brazil from 2019 to 2029 (Source: Statista)

Brazil is famous for its strong love for sports, especially football (soccer), volleyball and basketball. The country has tons of devoted fans who are really into sports. This passion for sports makes it a great place for sports betting, with plenty of potential users who are super into sports events.

Brazilians are interested in local sports leagues and major international events like the FIFA World Cup, Olympic Games, and UEFA Champions League. This global interest in sports provides year-round engagement opportunities for betting brands.

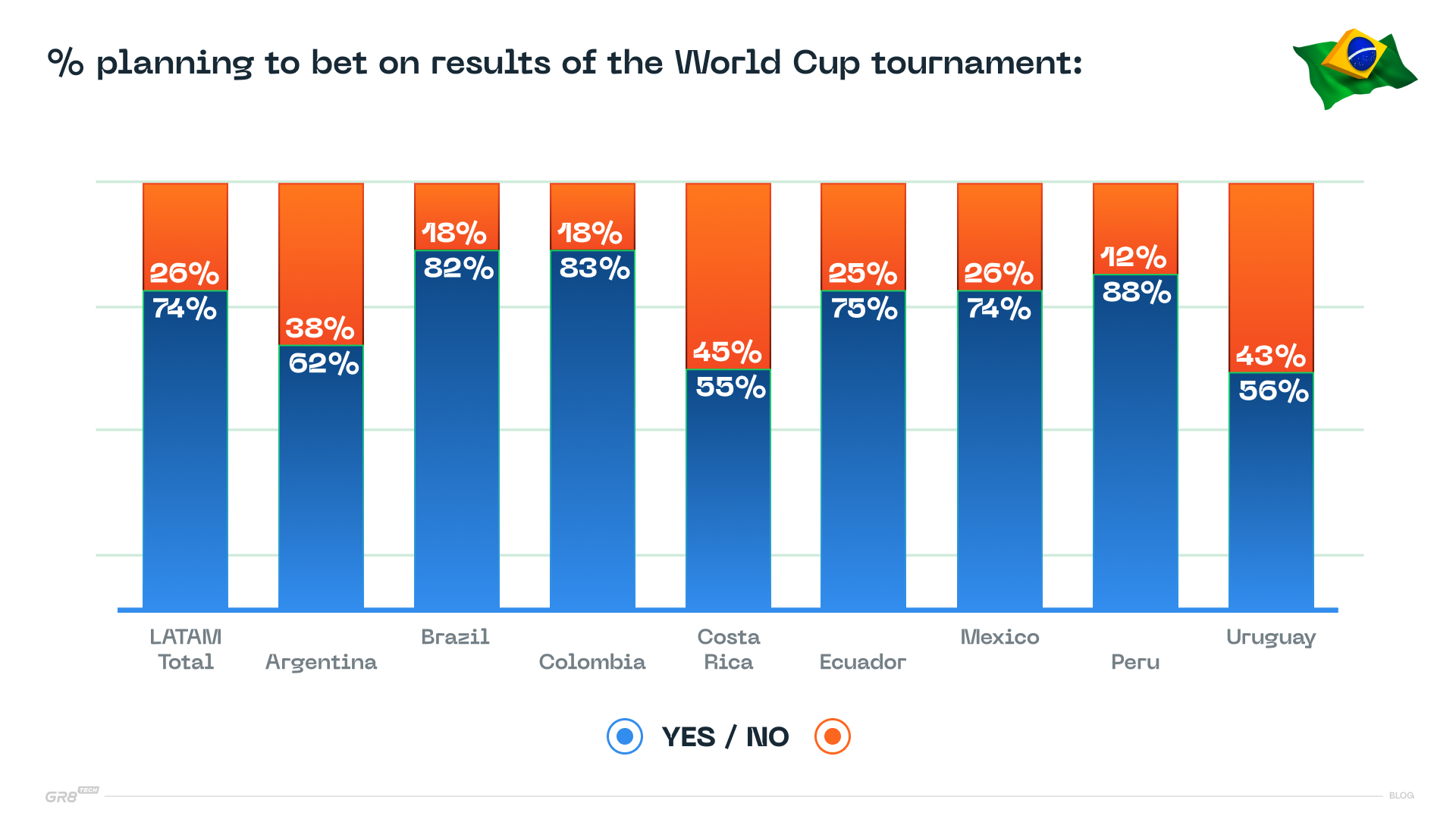

World Cup predictions and bets in LATAM (Source: TGM Research)

But what also matters, along with the high population, growing economy, regulatory shifts (more on that later), and love for sports, is the cultural acceptance of gambling and betting.

Gambling, including lotteries, poker, and sports betting, is generally accepted in Brazilian culture. This cultural openness leads to higher conversion rates and a more receptive market for new iGaming platforms.

Market Characteristics

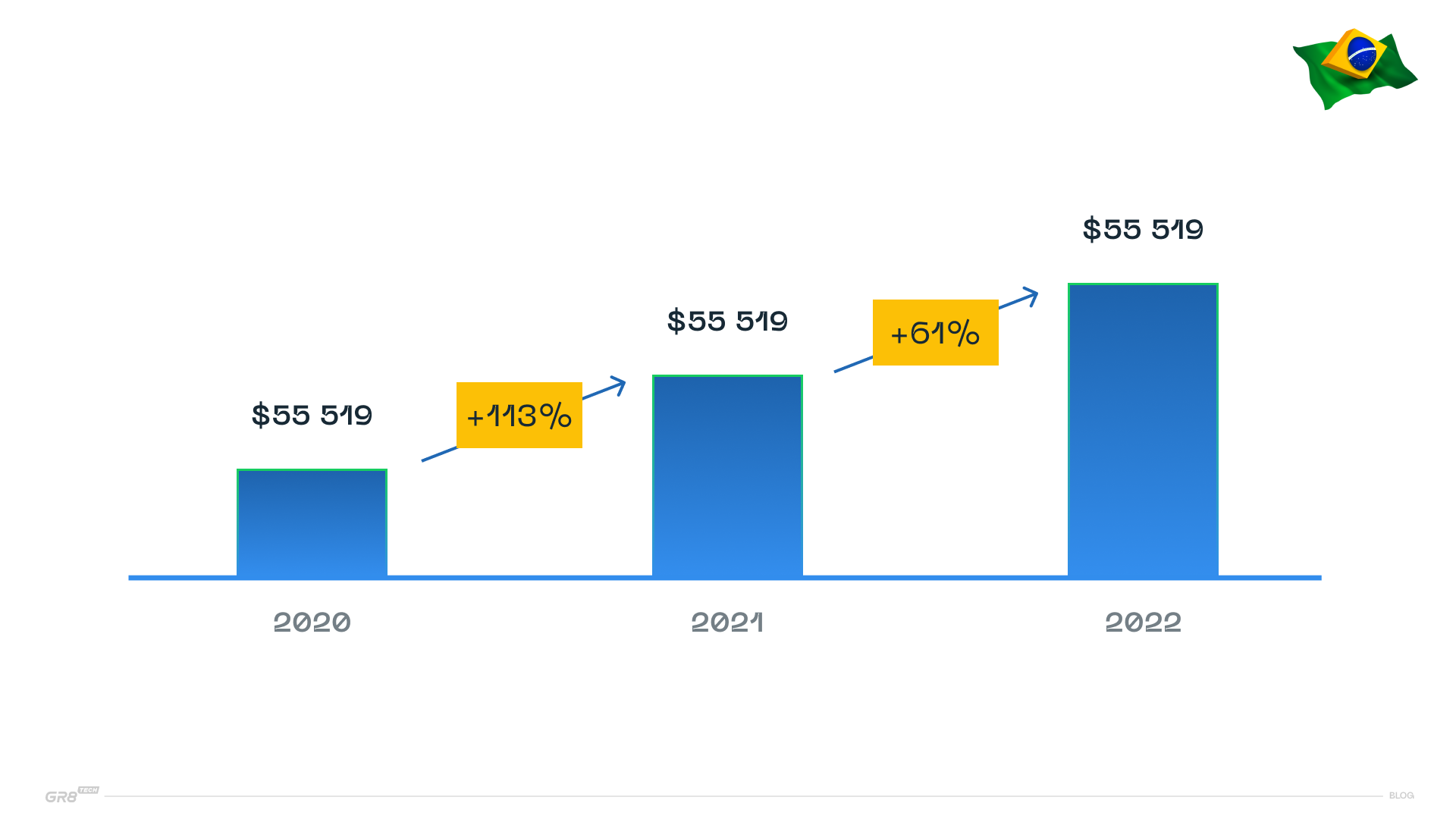

According to Redirection International’s study, online sports betting in Brazil is expected to grow by an average of 50% annually until 2028. The M&A firm attributes this to the market’s increasing popularity, technological advancements, and the entry of big international companies.

Experts think Brazil will become one of the biggest global online sports betting markets due to the many users of sports betting sites. In 2022 alone, Brazil had 3.2 billion accesses to these sites, even though the market doesn’t have solid regulations yet.

Aposta Legal Brasil data shows that 80% of Brazilians betting online place their wagers on football, with 13% betting on esports and 12% on basketball. Datahub found that Brazil’s number of sports betting companies jumped from 51 to 239 between 2020 and 2022, a huge 368.6% rise. They also found out that 80% of betting revenue comes from online casinos, and the total sector turnover increased by 130% in 2023 to around BRL120bn.

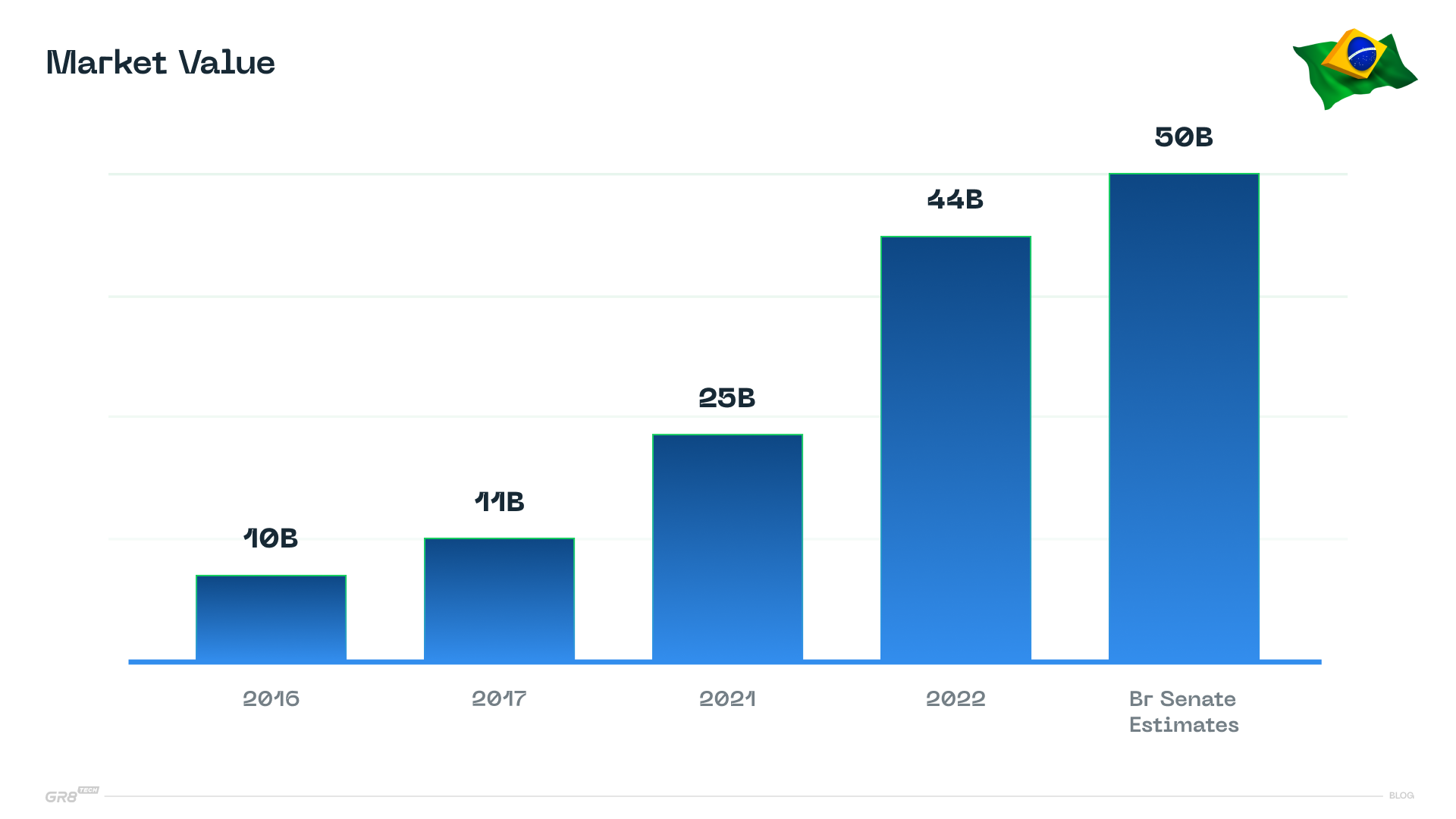

Estimated market size potential (Source: ENV MEDIA)

Demographic Insights Into Brazilian Bettors

The typical gambler profile in Brazil consists of adult men from the upper-middle class with foundational education levels. About 60% of these individuals are single and primarily reside in the Southeast and Northeast regions, making up 68% of the market.

Of these individuals, 84% are male, 39% are heads of household, 57% are single, 21% are married, and 11% have an academic degree.

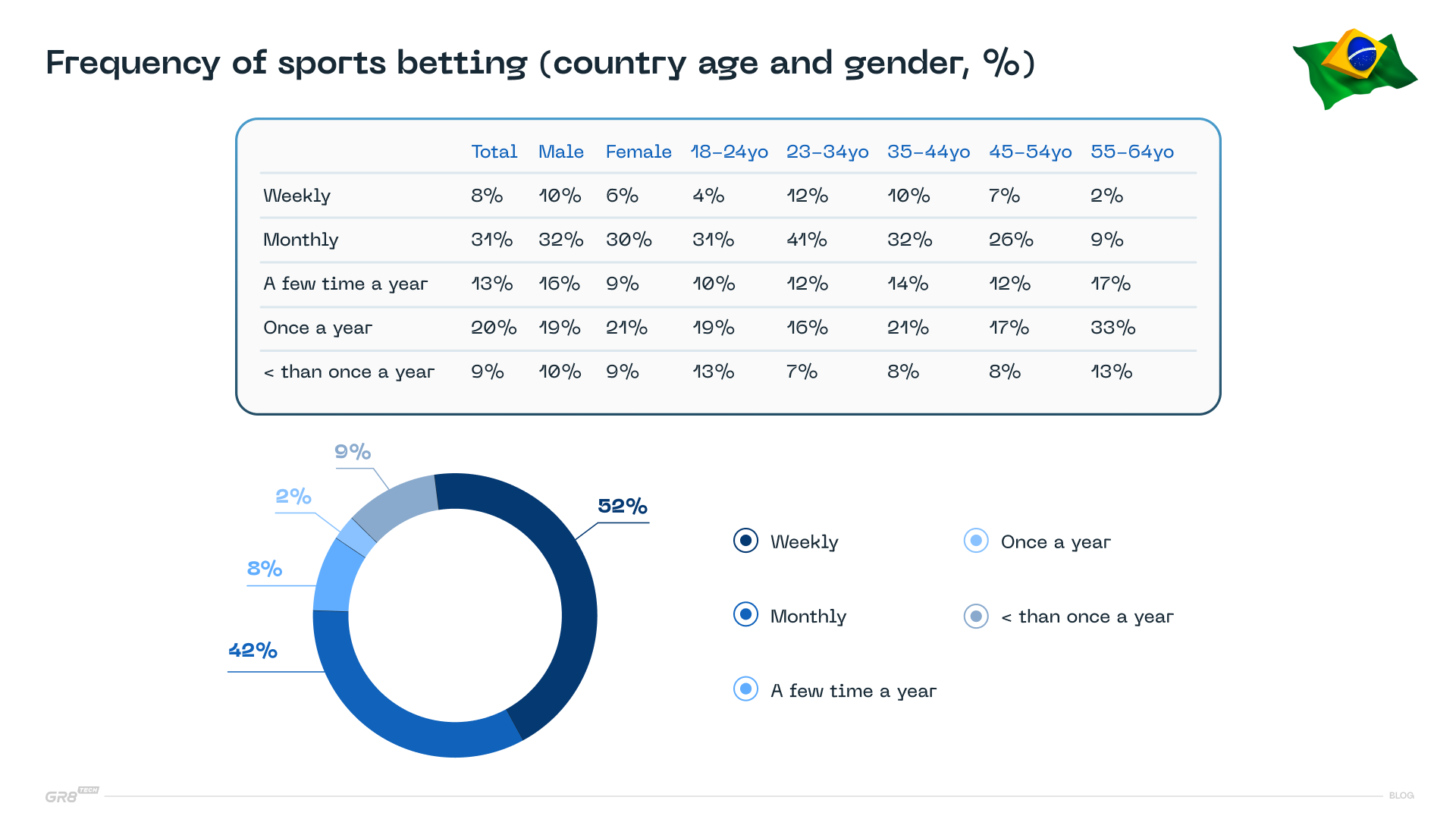

While there are frequent users, most of them only place bets a few times per month, mainly focusing on football. Additionally, they are not comfortable placing large bets at once.

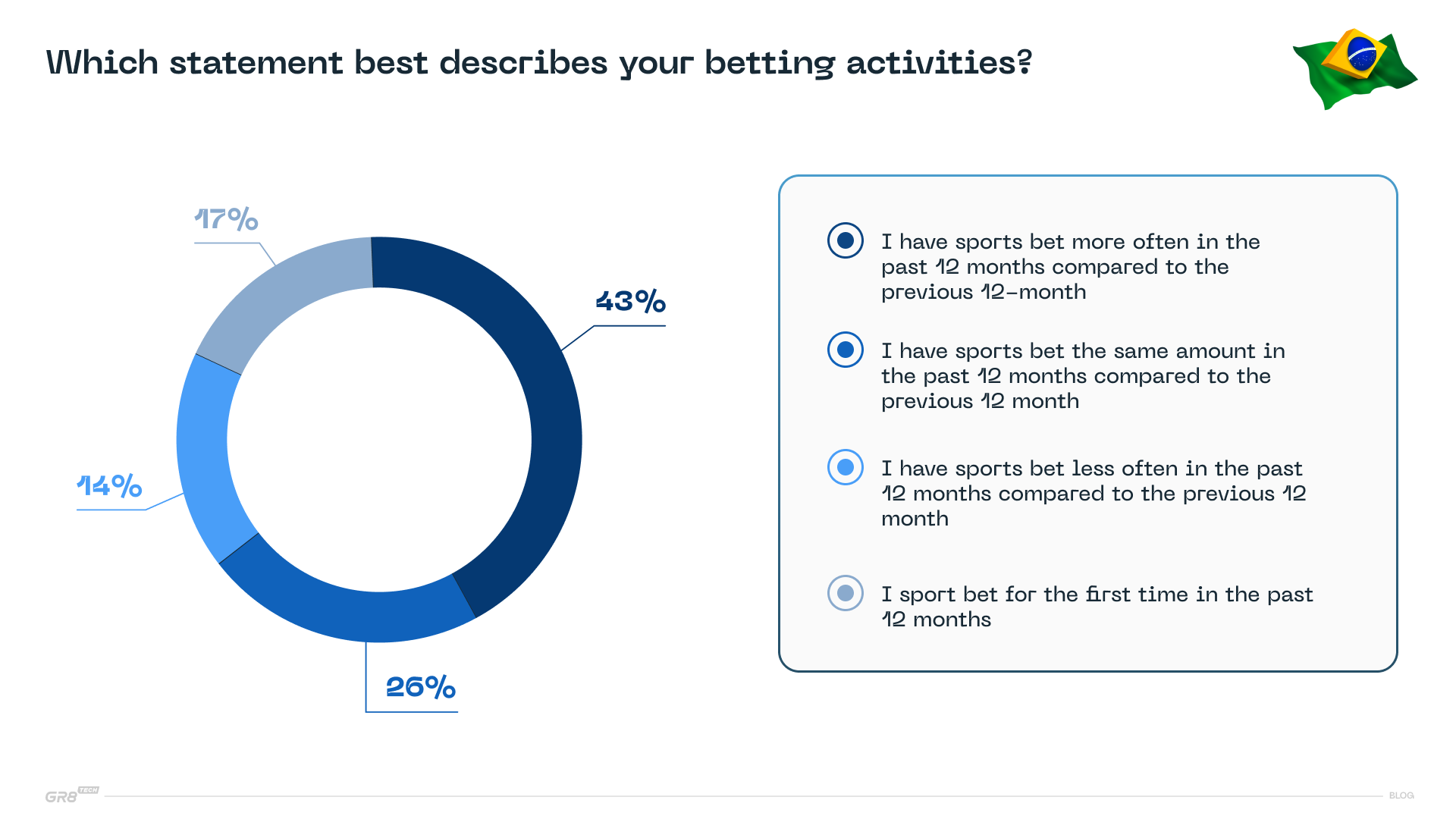

Betting frequency in Brazil (Source: TGM Research)

This target group requires access to the Internet and TV to consume news, sports, and financial information. They tend to prioritize safety when it comes to personal finances.

Brazilian bets frequency (Source: TGM Research)

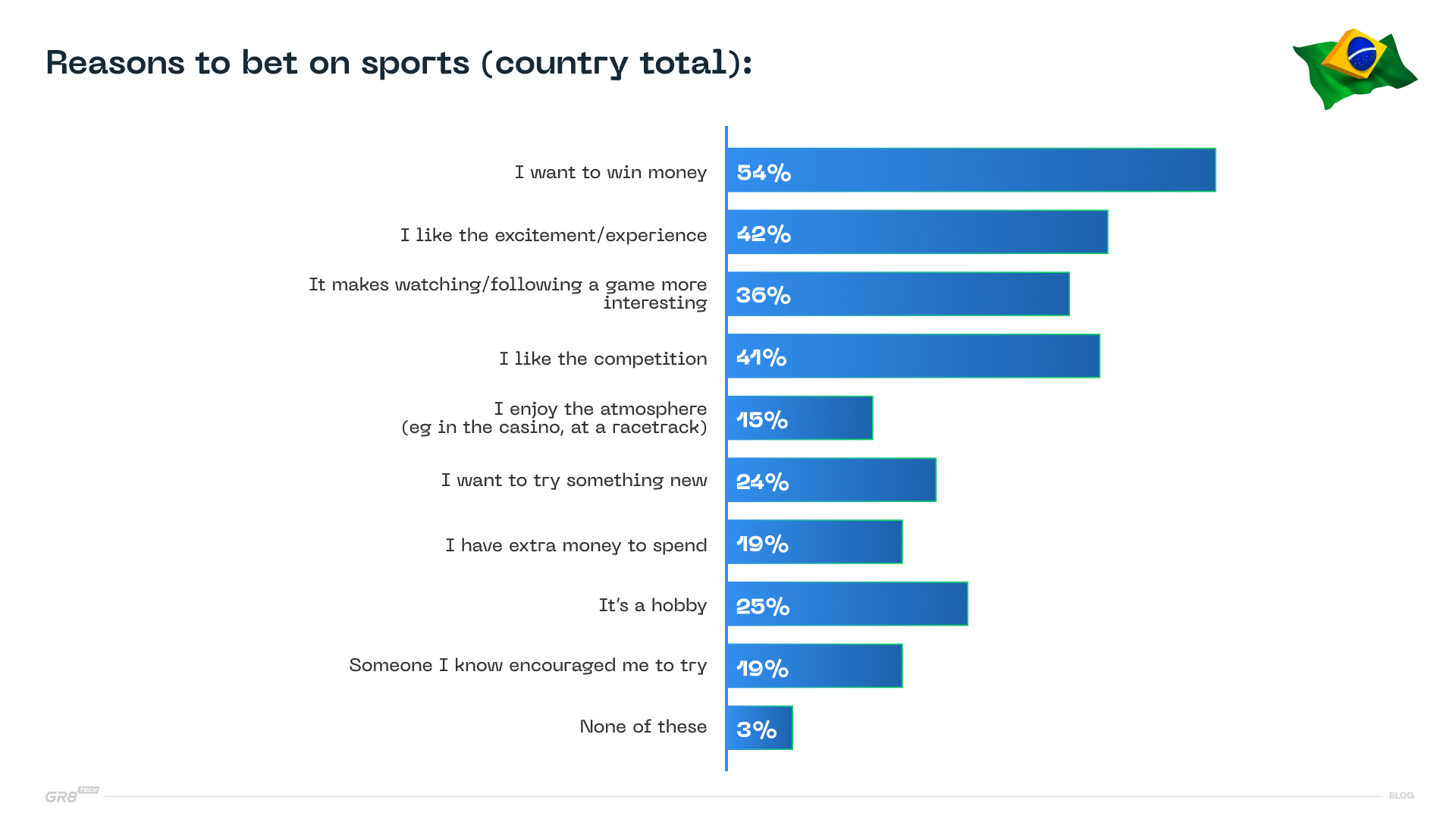

Latin America is second after Africa in terms of motivations for betting. Within Latin America, Brazil is among the countries where the primary reason for placing bets is the desire to win money. However, it is worth noting that a significant percentage of bettors in Brazil also value fun, the competitive aspect, and the excitement of betting.

Betting motivations in Brazil (Source: TGM Research)

Thorny Path to Brazil Sports Betting Regulation

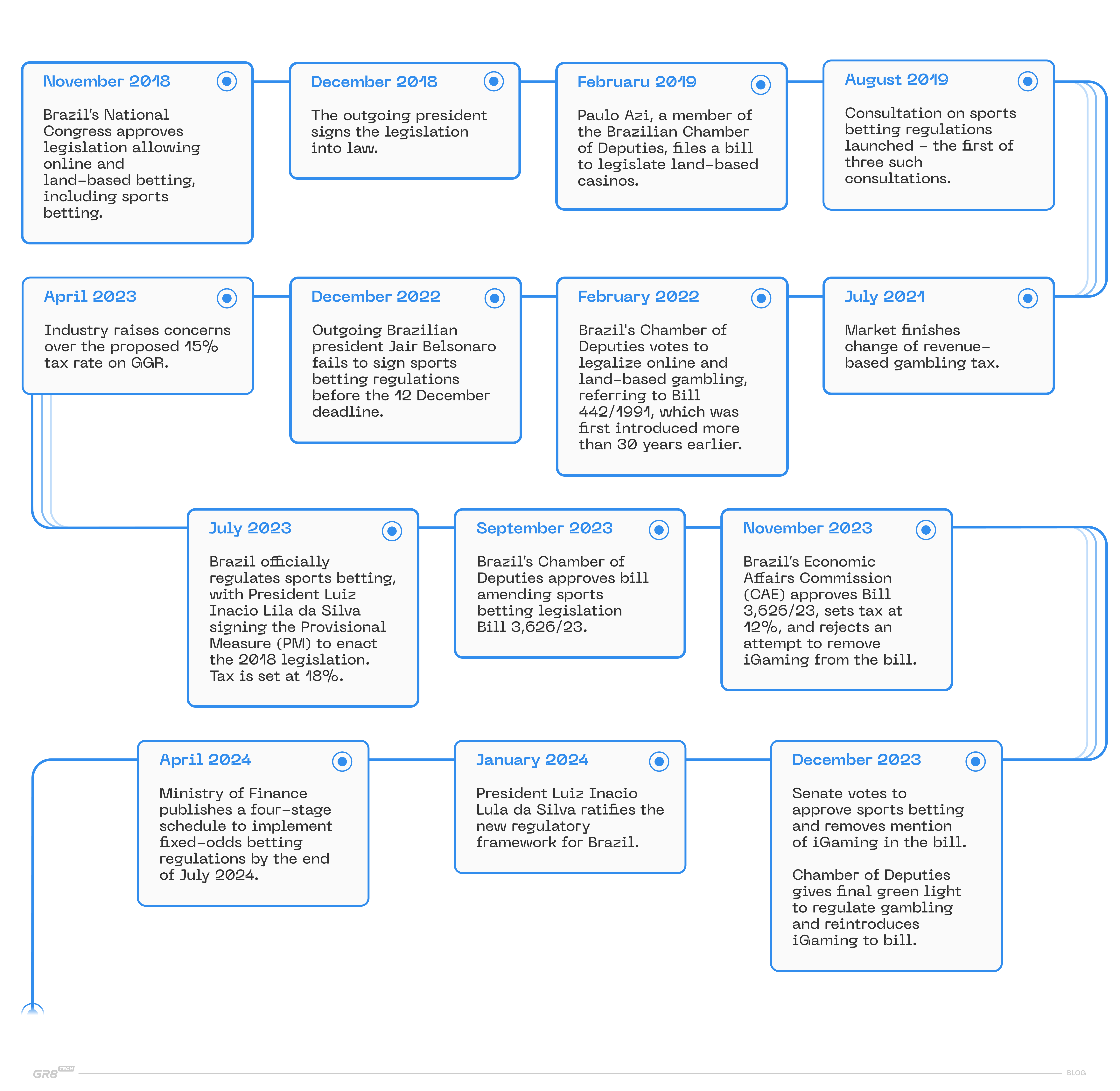

As Brazil moves toward regulating sports betting and iGaming, the passing of Bill 3,626/23 is a big moment. With the market set to open, companies in the industry are getting ready for new legal standards and operational requirements that will reshape the industry.

Brazil Betting Regulation Note

Bill 3,626/23—regulated sports betting and iGaming in Brazil: The Bill was approved by the Chamber of Deputies in December 2023 and signed into law by President Luiz Inacio Lula da Silva that same month.

Regulator: Regulatory Policy of the Prizes and Betting Secretariat (SPA)

Regulated products: Online gaming and sports betting approved with Bill 3,626 signed in 2023

Tax rate: 12% of GGR. The rate was previously set at 18% before being lowered

License fee: R$30m and will last for five years

Introduction to Bill 3,626/23

Bill 3,626/23's journey through Brazil's legislative channels has sparked significant debate and anticipation. As the bill nears implementation, it introduces a framework that mandates significant involvement from Brazilian stakeholders in any foreign betting operation. Specifically, the bill requires that all operators have at least 20% ownership held by Brazilian shareholders—a rule to ensure local benefits from the growing market.

The stipulation for a minimum local ownership presents both a challenge and an opportunity. While it acts as a barrier to entry by necessitating local partnerships, it also fosters a more integrated and cooperative business environment. Legal experts, including André Santa Ritta from Pinheiro Neto Advogados, highlight the dual nature of this requirement: it compels international companies to forge substantial connections within Brazil, potentially leading to more sustainable and locally attuned operations.

There is still a question about whether an individual must hold the 20% ownership requirement or whether it can be met through corporate ownership. This unclear situation has led to discussions about whether this rule is in line with the Constitution, suggesting that changes or clarifications may be necessary as the regulations are finalized.

Market Preparation and Adaptation

As the Brazilian market prepares for the official rollout of sports betting and iGaming, operators are busy establishing the necessary infrastructure and partnerships. The anticipation of regulatory approval has prompted a flurry of activity, from forming alliances with major Brazilian media houses to setting up operational frameworks that align with anticipated legal standards.

In recent years, media investments have aggressively increased. By 2022, the number of players with relevant investments jumped from 36 to 48 in two years. (Source: IBOPE MONITOR)

Taxation and Financial Implications

The new law's financial rules, especially about taxes, will greatly impact how the market works. Some proposed taxes on money earned and player winnings have caused a lot of talk in the industry. As a result, changes were made, like lowering the money earned tax from 18% to 12%. However, the fixed tax on player winnings is still being argued about, with ongoing talks about how it will affect players and the overall market.

The Regulatory Road

Looking forward, regulating online gaming and re-integrating iGaming into the legislative framework promise to broaden the scope of legal betting in Brazil. These developments are seen as positive strides towards creating a robust and diversified Brazilian gambling environment. Key legal practitioners and market analysts foresee rapid growth and adjustment as Brazil seeks to position itself as a leading player in the global iGaming and sports betting arena.

The legislation road of betting in Brazil (Source: IGB LatAm report 2024)

With improved regulation policies in place, people will feel more at ease about betting and will have no need to worry about it.

Thomas Charvahales, Senior Business Development Manager at GR8 Tech

What You Need to Know About Operations in Brazil

In Brazil, the casino sector accounts for 70-80% of the total revenue, significantly contributing to the overall market. While most operators include casinos, they cannot actively promote them. In such a situation, bet on Brazil sportsbook seems like the way to cope with restrictions and maximize revenue potential.

Another major hurdle to betting companies in Brazil is the uncertainty surrounding regulations. Brazil is in the process of implementing national regulations, but individual states will also have their own specific rules. This lack of clarity confuses operators regarding the required licenses and associated costs.

Sometimes, operators need help understanding how many licenses they must pay for. Do they have to pay 30 million reals for the national license and 5 million more for the state of Rio de Janeiro? And what about other states? How many for other states? It confuses them.

Thomas Charvahales, Senior Business Development Manager at GR8 Tech

In the past, the absence of clear regulations empowered Brazilian banks to block gambling-related transactions, particularly those made with credit cards. As a result, the preferred payment method has shifted to bank-to-bank cash transfers, known as Pix, accounting for 90% of transactions. However, challenges persist with Pix, leading to significant payment inefficiencies.

Furthermore, operators face the challenge of identifying reliable payment service providers (PSPs) due to concerns about money laundering and criminal connections. The solution here is to collaborate with PSPs certified by the National Bank of Brazil, such as Nubank, Banco do Brasil, Itaú Unibanco, Bradesco, Santander Brasil, Caixa Econômica Federal, Inter, Mercado Pago, PagSeguro, and PicPay.

Despite the hype around the Brazilian iGaming market's significant potential, there is a need for more skilled professionals. Especially in platform development, marketing, business analysis, and customer relationship management (CRM). As a result, companies are either recruiting talent from established markets or investing in developing expertise within the country, although the latter approach requires more time and effort.

Thomas Charvahales, Senior Business Development Manager at GR8 Tech

Betting on Brazil Requires True Localization

Operators entering Brazil believe that making money in such a large market should be easy. They use "Fake Google Translate localization" on their websites and think that this is enough. Moreover, some are even unaware that Brazilians mainly speak Portuguese, not Spanish.

Once, a European operator put a sombrero on Ronaldinho as part of their marketing campaign. Such an approach doesn't come close to the advantage betting brands can get by using proper localization in the market.

Thomas Charvahales, Senior Business Development Manager at GR8 Tech

Brazil holds great potential as a market, but strategies that work in the USA or Europe may not necessarily be successful there. Market leaders understand that to grab significant market share, they need to dive deep into local culture and language.

Effective localization involves thorough research into demographics and cultural differences, collaboration with local agencies, or hiring local specialists to assist with marketing strategies before launching. It's not about simply imitating the local style.

What About Technologies

In Brazil, new bettors often ask simple questions:

- How does online betting work?

- What sports can I bet on?

- What are the major sports championships available?

- Should I use a website or an app?

- What are the benefits, and how can I earn money through betting?

These queries reflect a growing interest among Brazilians in understanding the mechanics of sports betting and identifying platforms that offer a comprehensive range of options. As the market matures, betting becomes more popular as one of the leisure activities in Brazil. This increase shifting operators toward providing the best player experience on sports betting sites.

According to survey results, 49% of Brazilians consider simple payment methods a key factor when choosing a bookmaker for placing bets. The main reasons that discourage sports bettors in Brazil are transaction delays and weak security protocols on the platform. This number one priority for operators picking the platform.

Demand On Pro Trading

Operators in Brazil are increasingly recognizing the importance of advanced trending and margin management. The benchmark in Brazil is an 8-10% margin. However, while some operators have experienced revenue loss due to a 4% margin, brands with effective margin management can achieve a remarkable 15% margin. Such examples create a demand for more sophisticated odds data, flexible player segmentation, and risk management to prevent fraud and losses.

Prioritizing Easy-to-Use Websites and Apps

The Brazilian bettors seek platforms that offer not only a wide range of betting options but also a user-friendly experience. Initial impressions are often based on technical aspects such as ease of use, speed of the platform, frequency of crashes, and overall usability. Positive reviews highlight platforms as "intuitive," "simple," and "reliable," underscoring the importance of these attributes.

As users become more experienced, they compare different betting sites more critically. Platforms that provide advanced betting features like cashout or bet builder gain more favorable reviews and higher user retention rates.

Mobile First, of Course

Reports on the website performance of the leading betting brands in Brazil show that in 2022, mobile traffic dominated desktop traffic. This percentage varies from brand to brand, starting at 60% and reaching an impressive 94%.

Unsurprisingly, customer preferences in Brazil have shifted towards online sports betting due to its convenience and accessibility. With the increasing penetration of smartphones and the internet, more people place bets online rather than go to bet offline. The ease of accessing a wide range of betting options and the ability to place bets anytime, anywhere, is undeniable.

Where Would We Be Without AI?

Artificial Intelligence already enhances bettor engagement and operational efficiency. AI algorithms analyze vast datasets to offer tailored betting options and predictions, increasing the accuracy of odds and personalizing user experiences. For example, sportsbooks utilize AI to adjust odds in real time based on game developments, significantly boosting in-play betting participation. AI also automates risk management by swiftly identifying fraud.

A study from the Federal University of Minas Gerais highlighted that AI-driven platforms could reduce fraud detection times by up to 50%, securing revenues and enhancing user trust. As AI technology advances, Brazilian operators who adopt these tools are likely to see increased customer retention and higher returns on investment.

💡 More about AI in iGaming in our articles: AI in iGaming: A Look into Machine Learning and Personalized Gaming Experience and More AI in iGaming: How Operators Benefit From Large Language Models.

There's an interesting non-tech trend happening right now. While classic sports like football, volleyball, and basketball still get a lot of bets, the NFL is also becoming more popular. As Brazilians get more into the NFL, it could help betting operators make up for the slow season in December. So, if you want to increase your profits, think about adding the NFL to your options.

Thomas Charvahales, Senior Business Development Manager at GR8 Tech

Bet on Brazil: Opportunities for Growth

Esports are gaining popularity in Brazil. The country hosts large tournaments across various disciplines, and people of all ages participate in esports betting. This trend shows no sign of slowing down.

Esports opportunities come with risks. I believe that esports will become the next big thing. However, not many operators invest in this field, except for Open Bet. Traditional platforms do not value esports as much.

Thomas Charvahales, Senior Business Development Manager at GR8 Tech

Another way of expanding could be incorporating social betting features, where people bet not against the operator but against each other. This feature aligns with Brazilians' cultural preferences, and with more true localization, more features will arise.

Also, the development of Brazil's regulatory framework, stable market, and investment security will boost businesses. The introduction of more advanced betting options like in-play betting and virtual sports is expected to meet the changing needs of Brazilian bettors, leading to further expansion.

Additionally, classics like forming partnerships with major football clubs and sports events provide direct access to a dedicated audience, increasing engagement and driving growth.

Closing Thoughts

Starting a sportsbook in Brazil looks promising, but plenty of challenges are ahead. The key to a profitable margin is matching platform solutions from established markets with local partners to understand Brazil’s spirit better. Adapting marketing strategies to align with Brazilian cultural preferences and using local sports figures can further increase relevance and appeal.

Everything is moving to mobile, and Brazil sports betting too. Betting brands should pay extra attention to the mobile apps of platform providers. An optimized, user-friendly mobile interface that helps better make his bet, especially for newcomers, will significantly enhance customer engagement and retention.

Additionally, operators must prioritize security to build trust among Brazilian bettors, who value smooth deposits and withdrawals. Staying agile and responsive to changes in regulatory and market conditions will help operators maintain competitiveness and capitalize on growth opportunities in Brazil.

I believe the key issue in the Brazilian market will revolve around casinos since we haven’t had land-based casinos since the 1940s. However, online casino gambling in Brazil is a whole different story to tell.

Thomas Charvahales, Senior Business Development Manager at GR8 Tech

🎙 What are your thoughts on starting a betting business in Brazil? Please share your opinion in the comments below, and let's spark a discussion.