You’ve probably seen the recent headlines: India is cracking down on fintech to curb money laundering, Brazil is considering bans on popular payment solutions like Pix, and tighter crypto regulations are reshaping Europe’s market.

With these sweeping changes, it’s only natural to wonder: how can your iGaming business keep up?

We’ve listed the five key online payment trends that will define the iGaming industry in 2025 to help you answer this question and prepare for what’s next.

1. Multi-PSP Payment Setup

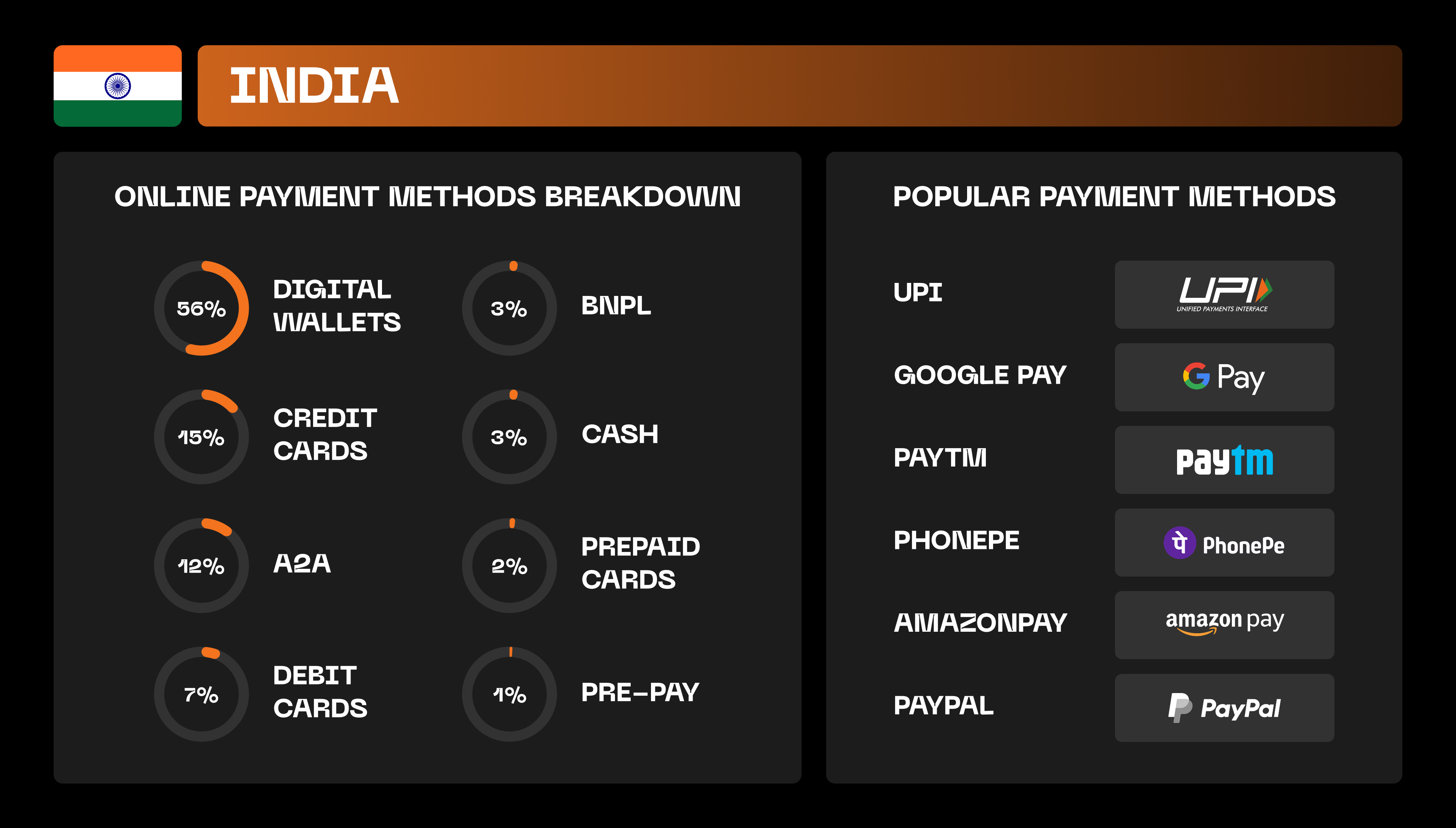

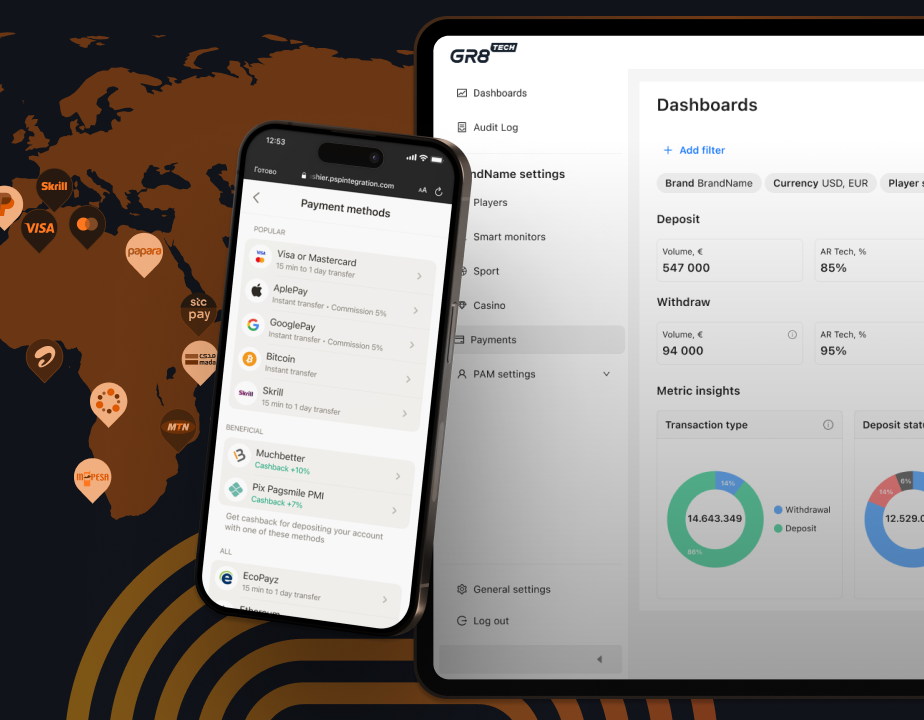

Picture this: you’re entering a high-potential market like India. Payment preferences here range from UPI to local bank transfers, with a growing demand for crypto. A single payment service provider (PSP) won’t cut it. You’ll need to integrate several payment services, each offering different methods and regional expertise. And that’s just to cover one market. The broader your geographical reach, the more PSPs you’ll need.

That’s why more and more iGaming businesses integrate with two or more PSPs. Once managing multiple providers manually becomes too tedious, they turn to payment gateways or orchestrators to handle complex tasks with multiple processing companies and methods. The global demand for these innovative solutions is already immense and is projected to grow by nearly 25% annually until 2030.

A multi-provider setup paired with the right gateway or orchestrator unlocks extra benefits for an iGaming business. With processing features like routing and cascading, you can dynamically allocate transactions to the payment provider offering the highest success rates or the lowest costs. If a provider experiences downtime or high failure rates, the system can instantly redirect payments to a backup vendor. This safeguards revenue and ensures a seamless user experience, keeping players engaged and transactions flowing.

Once you decide to expand to a new region, you’ll enjoy reduced time-to-market because a decent payment infrastructure provider will have many PSPs already implemented and ready for use. This way, you can go live in new territories in days instead of months.

This agility extends beyond the launch phase. With tools to monitor payment solution providers’ performance and make data-driven adjustments, you can continuously optimize your payment ecosystem — whether that means boosting user conversion rates, cutting processing costs, or quickly launching on new markets with pre-established payment providers with multiple methods.

The days of relying on a single provider are gone. A multi-PSP setup will equip your iGaming business with the tools to scale, adapt, and succeed anywhere.

2. Subscription-Based Models

Let’s face it: acquiring new players is expensive. For many online gambling operators and sportsbooks, customer acquisition costs (CAC) often exceed $1,000. Marketing budgets for the gambling industry’s big names range from about $20 million to a whopping $1 billion a year, consuming no less than 25% of their revenue.

That’s why subscription-based payment models are gaining momentum in 2025. Imagine offering players the ability to top up their accounts automatically every month — $100, like clockwork, with tokenization and secure auto-charging in place.

You can incentivize subscriptions by offering perks like exclusive odds or VIP rewards. For instance, a player subscribing to monthly deposits might receive access to premium tournaments or personalized promotions, creating a win-win for both the operator and the player.

Moreover, knowing how much, when, and how often players deposit allows operators to create detailed risk profiles and launch more effective marketing campaigns. Identifying inactive subscribers, for example, allows targeted re-engagement efforts through tailored push notifications or personalized offers — a surefire way to reactivate dormant players and boost their lifetime value (LTV).

Subscriptions are more than a payment model — they’re a powerful retention strategy. By keeping your existing players engaged, subscriptions boost your GGR while reducing fraud. In 2025, subscription models will shift from a “nice-to-have” to a competitive advantage for mature iGaming companies.

3. APMs Over Cards

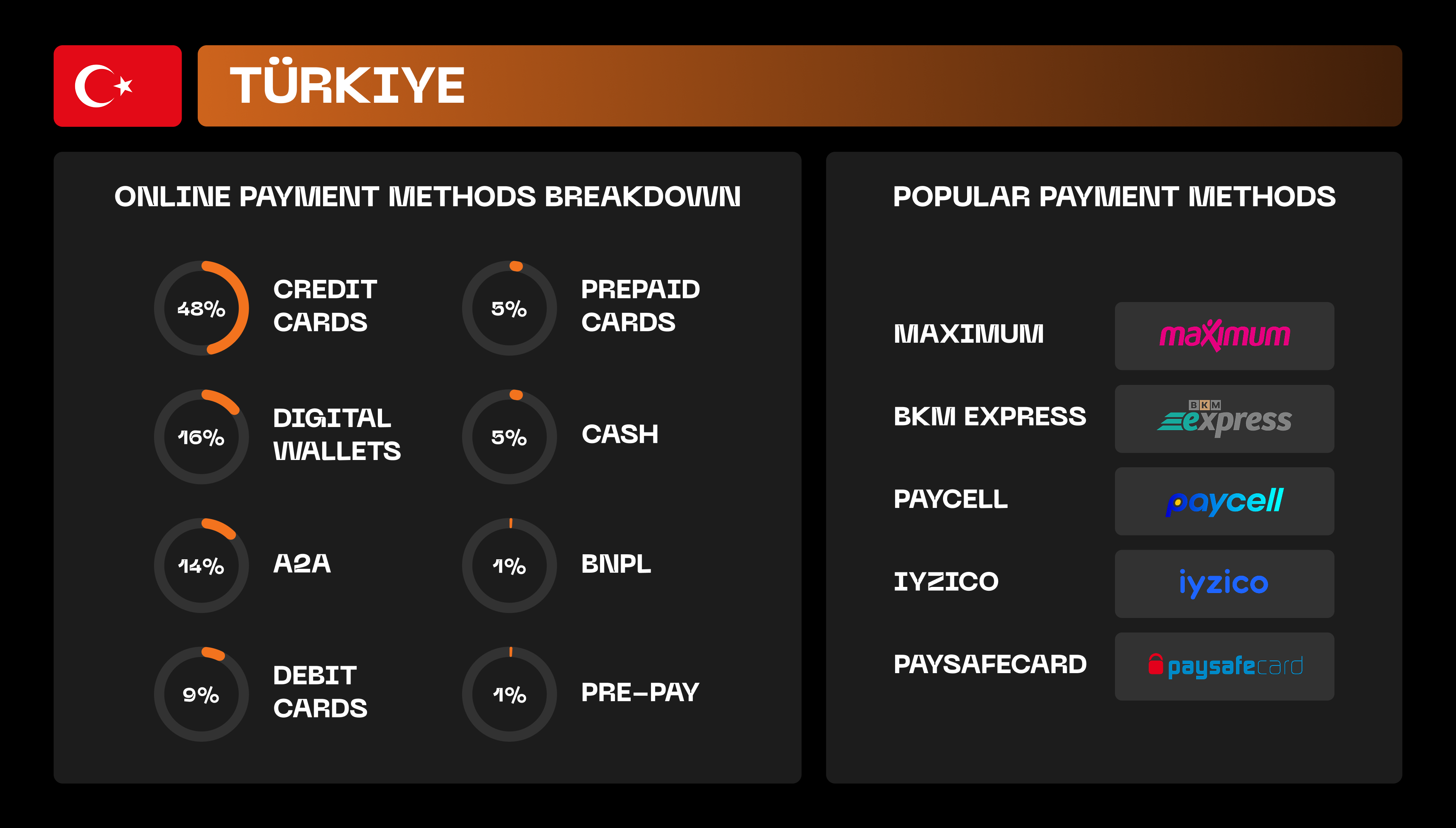

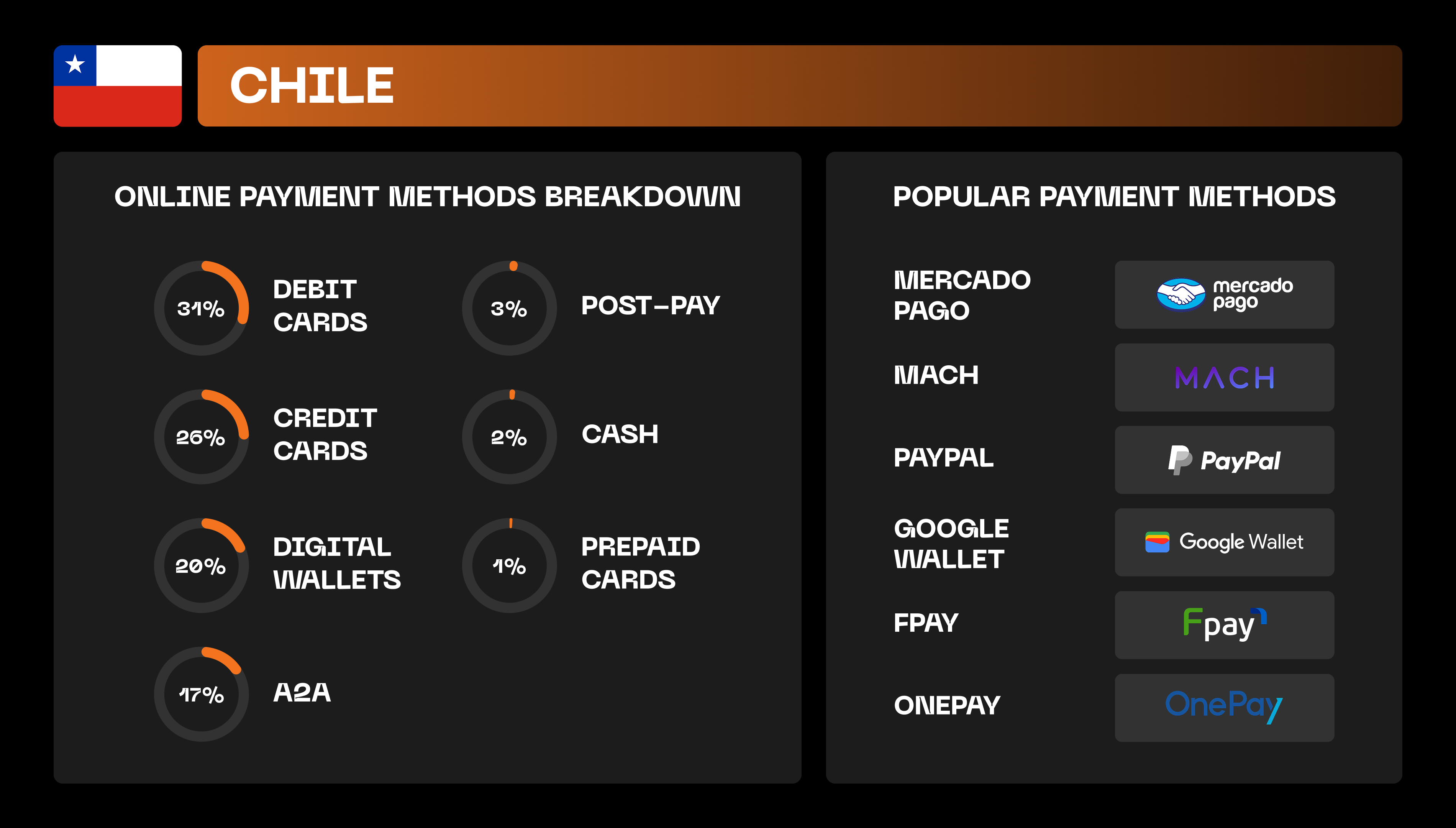

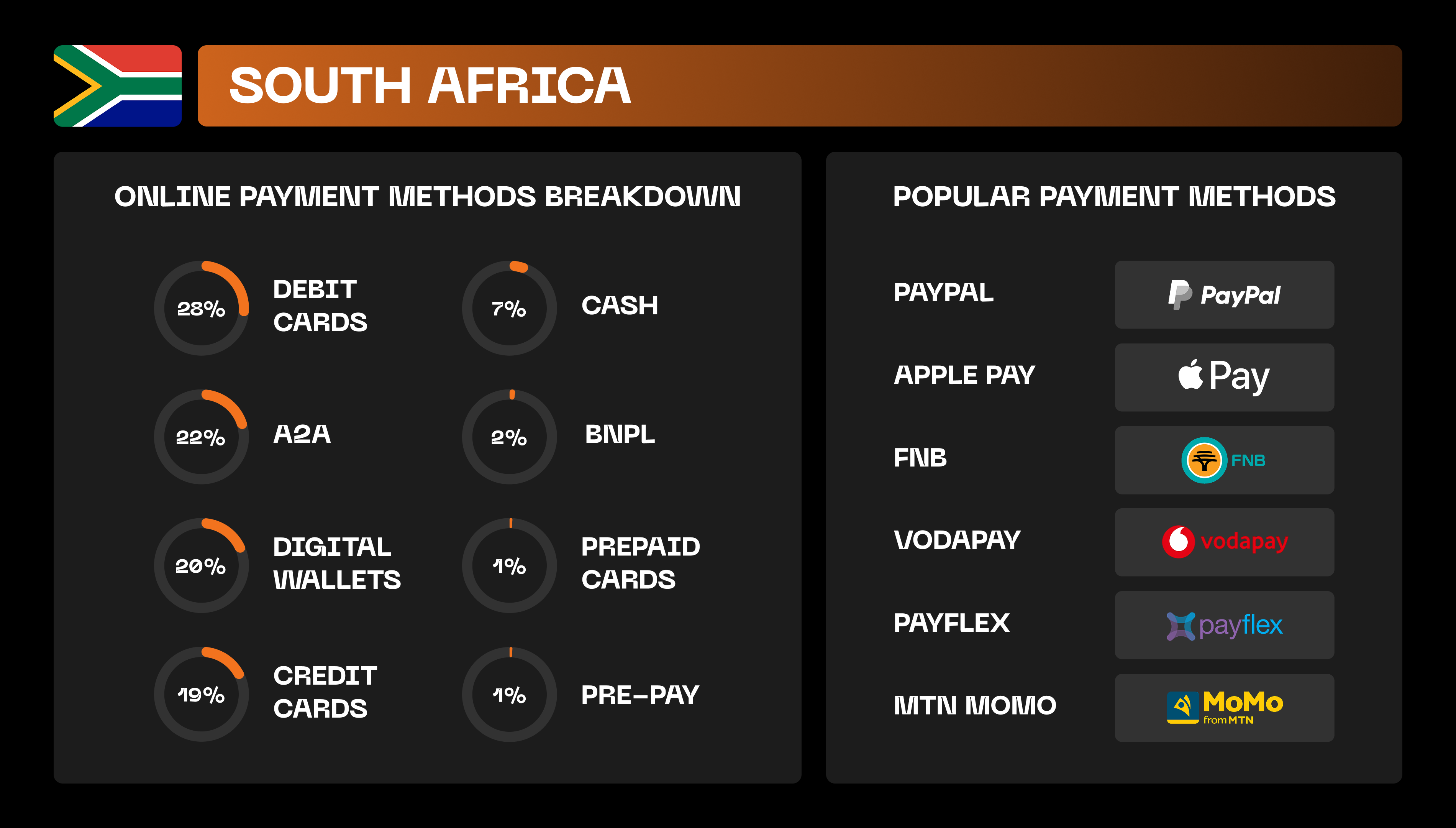

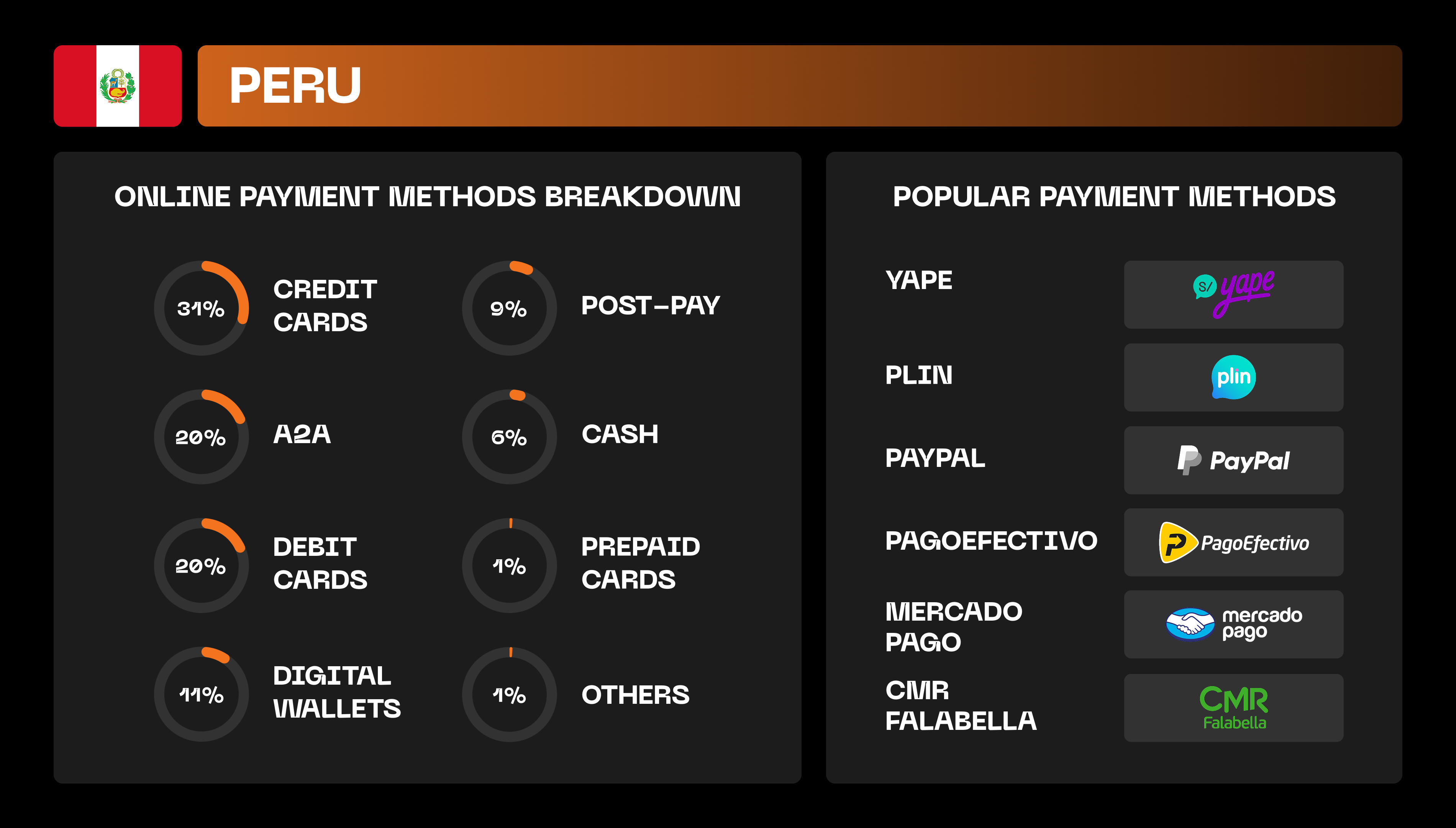

Emerging markets are rewriting the rulebook for payment methods. While cards remain king in Europe and other mature regions, young, fast-growing economies like India, Türkiye, Chile, Peru, and many African countries are embracing alternative payment methods (APMs). Mobile wallets, instant transfers, and localized solutions, such as mobile payments via M-PESA or T-kash in Africa, are the lifeblood of these markets, which leapfrogged traditional card-based infrastructures, diving straight into innovative, digital-first payment ecosystems.

Here’s why: the populations here are younger, digitally native, and demand fast, frictionless transactions. A few taps on a mobile wallet, and they’re ready to bet. In contrast, established markets cling to familiar card payments — a reflection of slower adaptation and aging demographics. Card payments imply higher fees, slower processing times, and stricter regulatory oversight. In contrast, APMs offer lower costs and faster transaction speeds, making them more appealing to operators and players alike.

The takeaway? Emerging markets are where the growth is happening, and APMs are leading the charge.

4. The Crypto Surge

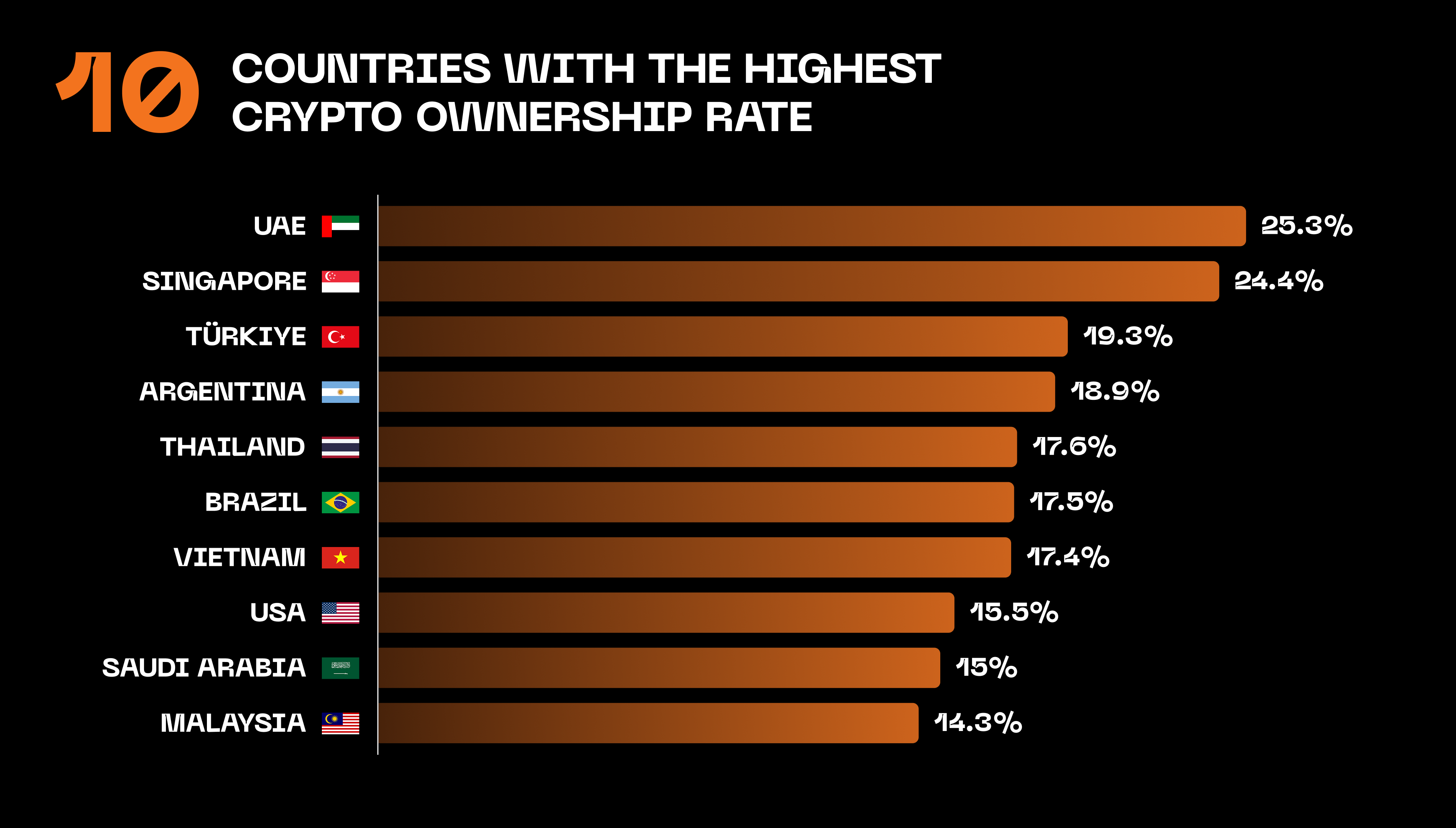

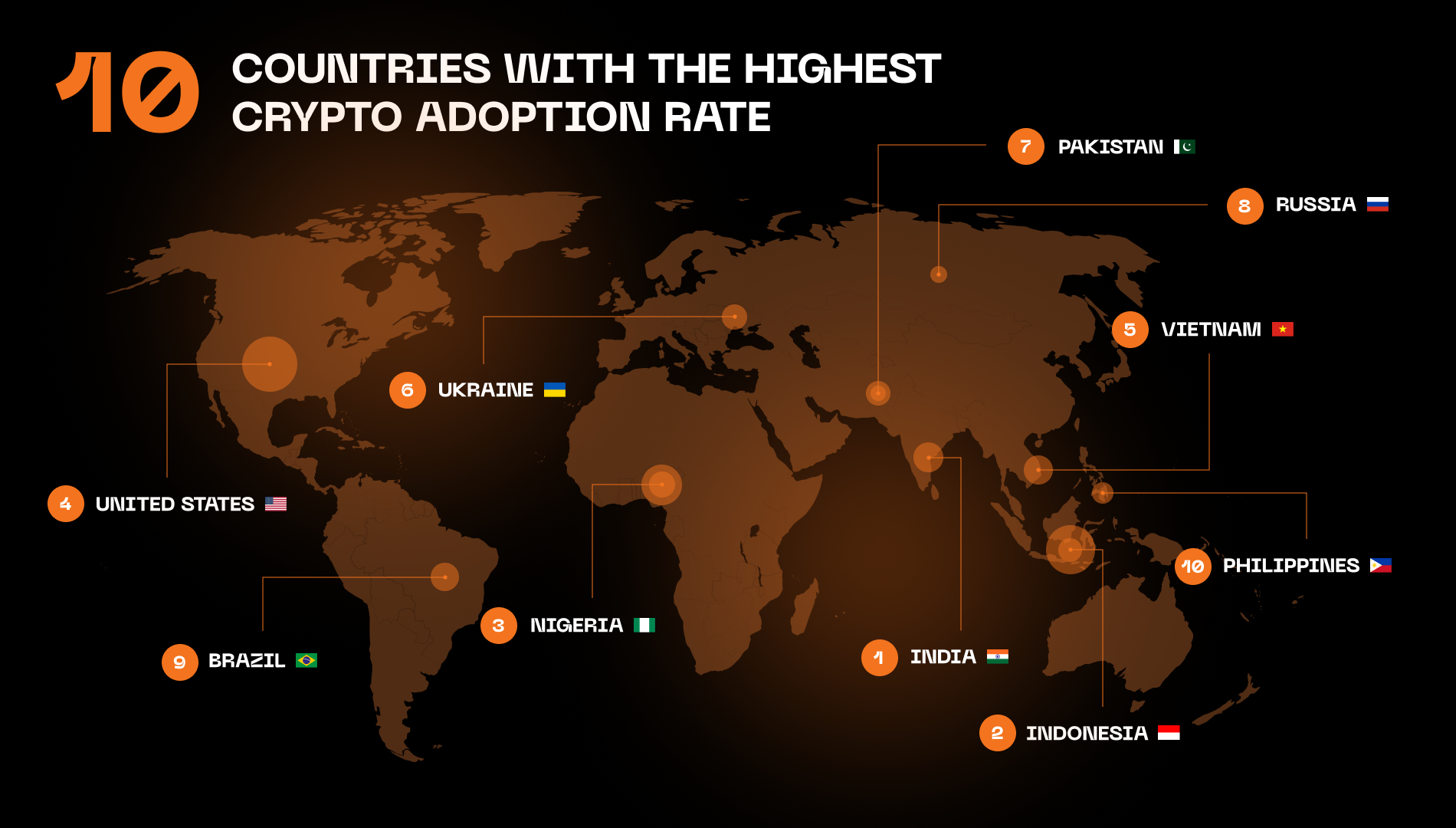

In 2025, cryptocurrency is no longer the fringe player it once was, especially since the president of the world's #1 economy launched his own coin. For iGaming operators, crypto is the ideal payment method. It offers cross-border payments, instant processing, lower or entirely waived transaction fees, fewer intermediaries, and the ability to offer players what they want: fast, secure transactions and decentralized payments with global accessibility. Crypto enables players to deposit and withdraw funds without the restrictions or delays often imposed by traditional banks.

Crypto tops the list of payment processing trends in markets across Africa, Latin America, Asia, and parts of Eastern Europe. These regions are embracing stablecoins and blockchain payments, which appeal to tech-savvy, mobile-first players.

Meanwhile, the European Union faces a new reality under the Markets in Crypto-Assets Regulation (MiCA). Designed to enhance consumer protection and market stability, MiCA imposes strict rules on stablecoin issuers, making things tougher for the iGaming sector.

Under MiCA, stablecoins must:

- Be fully backed by highly liquid reserves held in EU financial institutions.

- Provide regular audits and public transparency on reserves and liquidity.

- Cap daily transaction volumes to avoid becoming “systemically significant.”

Stablecoins like USDT and DAI, which fail to meet these requirements, are already being delisted from major platforms like Coinbase. This shift is limiting options for players and operators in Europe, leaving MiCA-compliant stablecoins like USDC and EURC to dominate. While these regulations aim to reduce risks, they also risk monopolizing the market and eroding the decentralized spirit of crypto.

To summarize, you can stick to cards in oversaturated European markets, endure $1,000+ CAC, and fight for crumbs, or you can expand into high-growth markets where gaming and betting cultures are emerging. By embracing budget-friendly payment options like crypto and other APMs, you’ll tap into vast new user bases and unlock sustainable growth.

5. Lower Processing Costs

Payment processing costs can be a silent margin killer for operators handling thousands of transactions daily. In 2025, businesses are set to fight back and slash expenses.

Here’s the deal: APMs and crypto aren’t just trendier than cards — they’re cheaper too. Traditional card processing often carries bank fees, hidden risks, and rigid structures. In contrast, decentralized crypto transactions offer near-zero fees, and APMs like mobile wallets and direct bank transfers drop many intermediaries involved in card payments, significantly reducing transaction costs. These methods also provide faster settlement times, easing cash flow constraints for operators. As APMs and crypto adoption grow, operators will gradually lighten the burden of payment processing fees.

It’s also worth revisiting the payment industry trend of multi-provider setups. Payment routing provides extra leverage for managing processing costs, allowing you to save up to 15-20% over time. For example, you may use one payment processing service for high-value transactions where reliability is paramount and another for smaller payments where cost savings take priority. You can also just cascade payments, starting with the cheapest route and automatically, invisibly for the user, switch to more expensive vendors with higher success rates if the first attempt fails.

This setup is especially valuable for increasing first-deposit conversions for new players and ensuring all deposits are processed smoothly during high-traffic events, like tournaments or competitions. By minimizing transaction failures in these critical moments, operators can further enhance player satisfaction and drive even better GGR.

Innovation Beyond Cost-Cutting

Cost-saving strategies aren’t just about reducing fees. Operators also implement creative approaches like staking systems, where players lock funds in their accounts to earn rewards or VIP perks. This gamified system boosts engagement and provides operators with liquidity to manage payment flows more efficiently.

Additionally, some iGaming platforms are experimenting with native tokens that can be used for payments or exchanged for rewards — a great way for operators to turn cost-cutting measures into new revenue streams, benefiting both their bottom line and player engagement.

The rewards for those who manage to adapt to these iGaming trends are clear: better margins, happier players, and a stronger position in a competitive market.

Capitalize On Trends With GR8 Tech

Whether you’re targeting high-growth regions like India, Türkiye, Chile, or Peru, or exploring the potential of alternative payment methods, crypto, and subscription models, we have the tools, expertise, and connections to ensure your success.

Our tried-and-true network spans diverse markets, offering localized solutions tailored to emerging economies. With GR8 Tech, you gain access to a robust multi-PSP setup, advanced payment routing, seamless integrations, and the flexibility to cater to any market’s unique needs.

References:

- https://www.grandviewresearch.com/industry-analysis/payment-orchestration-platform-market-report

- https://www.egr.global/northamerica/insight/conversion-corner-counting-the-costs-of-sports-betting-profitability/

- https://www.scaleo.io/blog/how-much-sportsbooks-spend-on-marketing-2024-updated-stats/

- https://www.singular.net/blog/user-acquisition-cost-benchmarks/

- https://www.esma.europa.eu/esmas-activities/digital-finance-and-innovation/markets-crypto-assets-regulation-mica

- https://www.binance.com/en/square/post/17510904843449